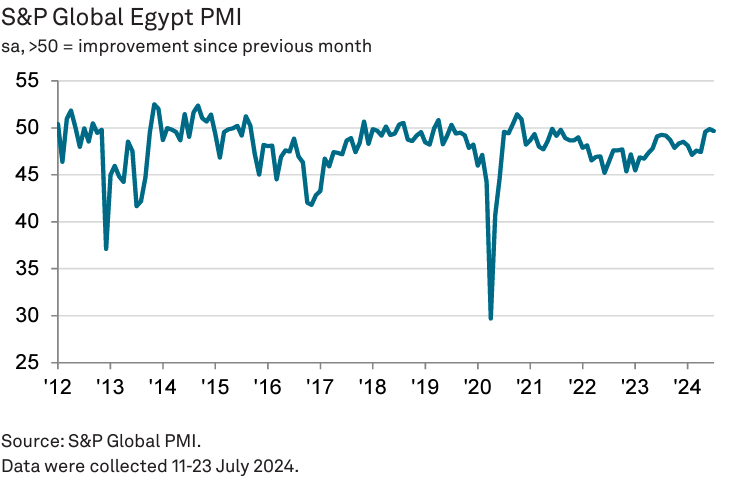

Egypt’s non-oil economy hovered near growth territory in July 2024, as the S&P Global Egypt Purchasing Managers’ Index (PMI) recorded a marginal decline in output and new business. The PMI, stood at 49.7, slightly below the 50.0 point that separates expansion from contraction. This reading followed a peak of 49.9 in June, marking the second-highest level in nearly three years.

Despite a dip in sales and output, employment in the non-oil sector rose in July, reversing a slight decline seen in the previous month. Firms remained cautiously optimistic about future output, with expectations improving slightly.

David Owen, Senior Economist at S&P Global Market Intelligence, noted that while export demand was rising, domestic market conditions remained weak.

Sales volumes, which had seen an uplift in June, ticked down in July, prompting firms to reduce their purchases. Approximately 9 per cent of surveyed firms reported a decline in sales, while 7 per cent noted an expansion. However, new export orders increased for the third consecutive month, driven by improved demand from foreign markets.

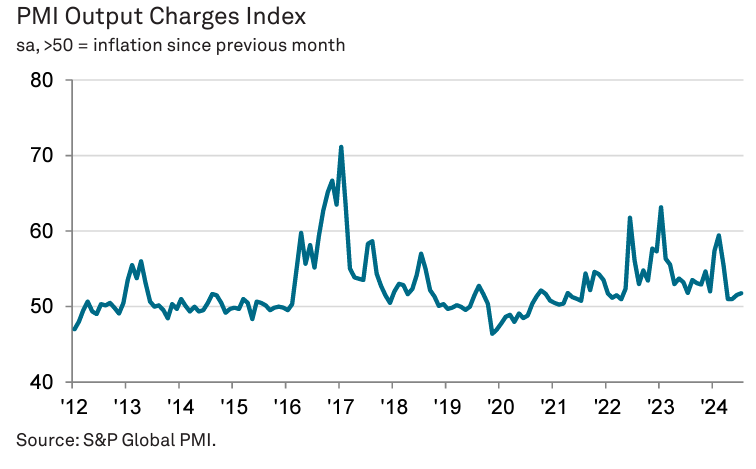

Price pressures showed signs of intensifying. Input costs rose at their steepest pace since March, leading to a modest increase in selling prices. About 14 per cent of businesses reported rising purchase prices, largely due to higher raw material costs.

The reduction in backlogs of work was the fastest since March 2023. Firms adjusted their input purchases to manage stock levels, with the reduction being the strongest recorded in four months.

While optimism among non-oil firms improved, it remained subdued compared to historical trends. Only 9 per cent of firms expressed a positive outlook for the next 12 months.

Owen noted that subdued inflationary pressures could pose a risk of prices picking up again and constraining business activity.

All in all, the PMI data highlights Egypt’s non-oil economy’s challenges with fluctuating demand and price pressures while showing tentative signs of stabilisation in the labor market.

Attribution: S&P Global Egypt Purchasing Managers’ Index (PMI)