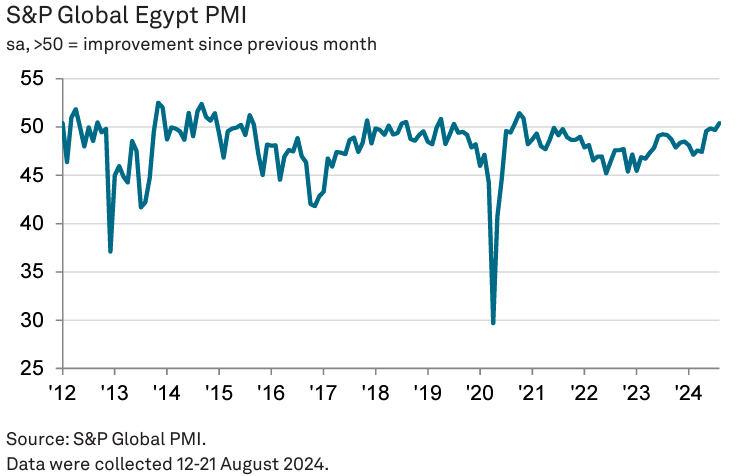

Egypt’s non-oil private sector experienced growth in August for the first time in three years, according to the S&P Global Egypt Purchasing Managers’ Index (PMI).

The PMI rose to 50.4 from 49.7 in July, surpassing the neutral threshold of 50.0 and marking the first improvement in business conditions since November 2020.

This growth was driven by increases in output, employment, and inventories, as businesses showed renewed confidence in the market. Although new orders slightly declined for the second consecutive month, firms responded to stabilising demand by boosting activity, hiring more staff, and expanding inventories. Business optimism reached its highest level since mid-2022.

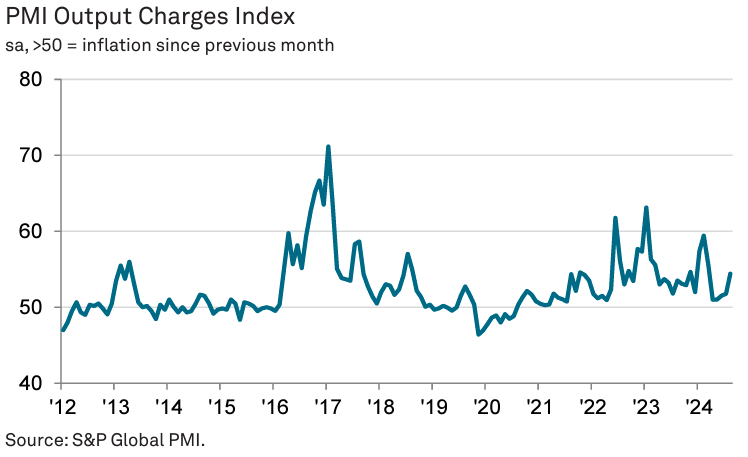

However, inflationary pressures intensified, with the weaker Egyptian pound (EGP) against the US dollar contributing to a sharp rise in input costs. This led to increased selling prices as businesses sought to protect their margins. Moreover, August data revealed the fastest rise in costs and charges in five months, posing a potential risk to future market recovery.

David Owen, Senior Economist at S&P Global Market Intelligence, commented that “business conditions are on the mend,” but noted that “challenges such as weak client demand and rising price pressures could limit further growth.” Despite these challenges, the expansion in activity and capacity indicates cautious optimism among firms regarding the economic outlook.

Attribution: S&P Global Egypt PMI

Subediting: M. S. Salama