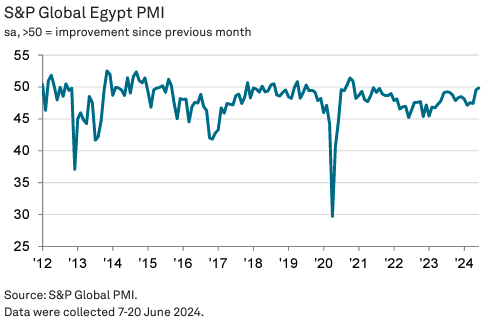

Egypt’s non-oil sector experienced a notable increase in new business volumes in June, marking the first rise since August 2021. The headline seasonally adjusted S&P Global Egypt Purchasing Managers’ Index (PMI) increased from 49.6 in May to 49.9 in June. This positive development follows recent indicators of stabilising economic conditions, supported by policy measures aimed at relaxing price pressures and improving demand prospects.

Improving Economic Conditions

The non-oil sector’s output levels fell at the slowest rate in nearly three years, signifying an almost stable performance. June also witnessed an increase in purchasing activity for the first time since December 2021. Despite a slight rise, price pressures remained relatively mild, further enhancing the economic outlook.

Stable Operating Conditions

Although still slightly below the 50.0 mark that separates growth from contraction, the PMI figure indicates broadly stable operating conditions at the end of the second quarter. Notably, the index reached its highest level in three years.

Rise in New Business Intakes

New business intakes at non-oil firms rose in June, marking the first increase since August 2021. This improvement was driven by better conditions in both domestic and international markets. Particularly, there was a sharp rise in new export orders, the strongest recorded in two-and-a-half years. The manufacturing and services sectors experienced growth in new orders, though declines in the construction and wholesale & retail sectors presented a mixed picture.

Inflationary Pressures and Business Response

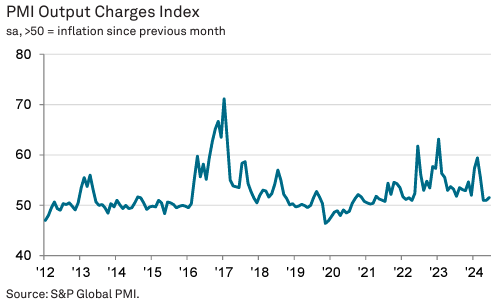

Inflationary pressures have been notably subdued compared to earlier this year. Although June saw the fastest rise in input prices for three months, firms attributed this to market price volatility rather than a sustained inflation trend. Consequently, businesses raised their output charges modestly.

Capacity Expansion and Employment Stability

With total sales rising, non-oil firms made efforts to expand their capacity, as reflected in the increased purchasing of inputs. Some companies boosted their activity, though this was counterbalanced by declines in other areas. Employment levels remained relatively stable, as firms were cautious about future activity amidst economic uncertainties. The overall rate of contraction in output slowed for the fourth consecutive month, recording the softest decline in nearly three years.

Attribution: S&P Global Egypt Purchasing Managers’ Index (PMI).