The US Energy Information Administration (EIA) has recently released a Country Analysis Brief on Egypt’s energy sector throughout 2022 and 2023, covering petroleum and other liquids, natural gas, coal, energy trade, and electricity.

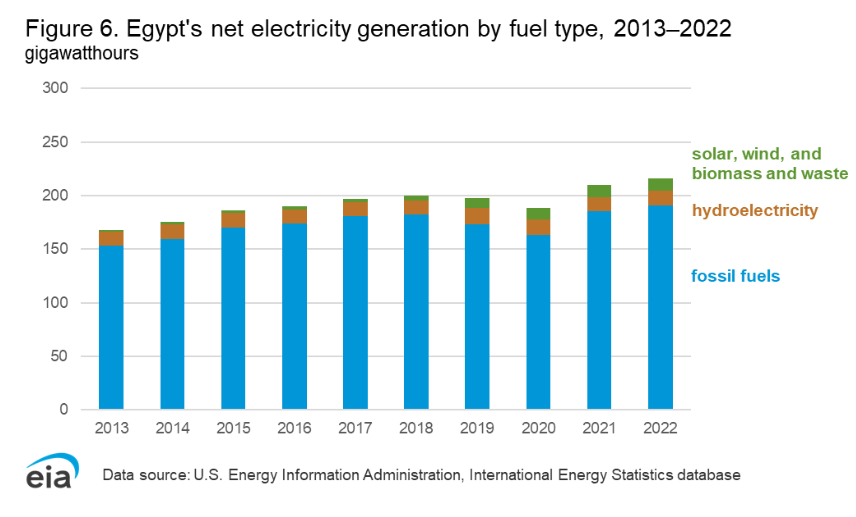

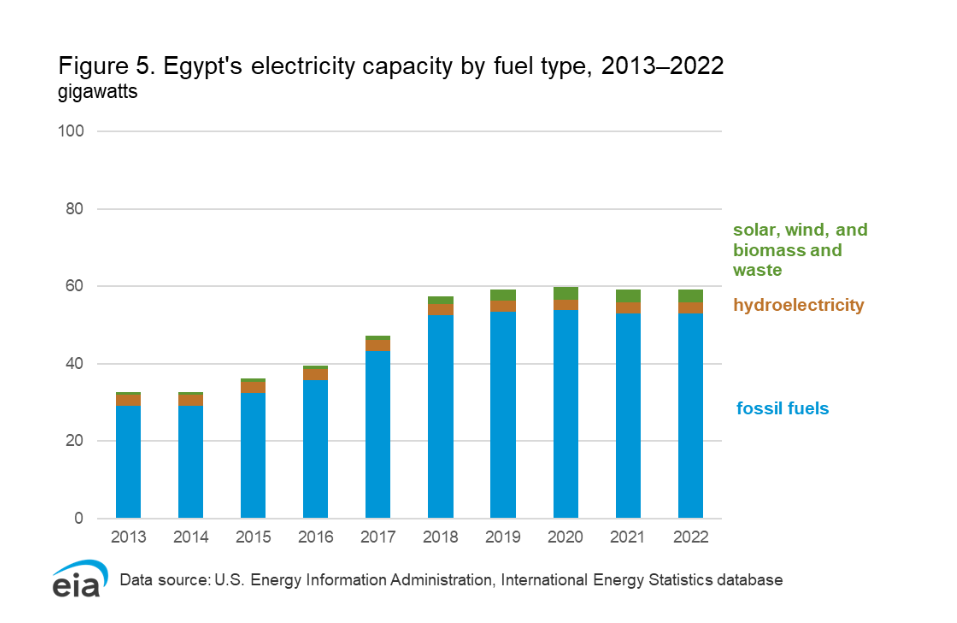

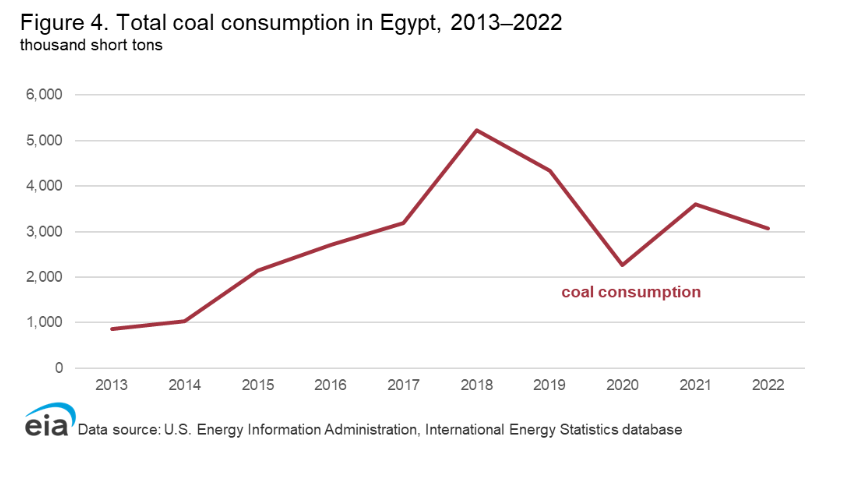

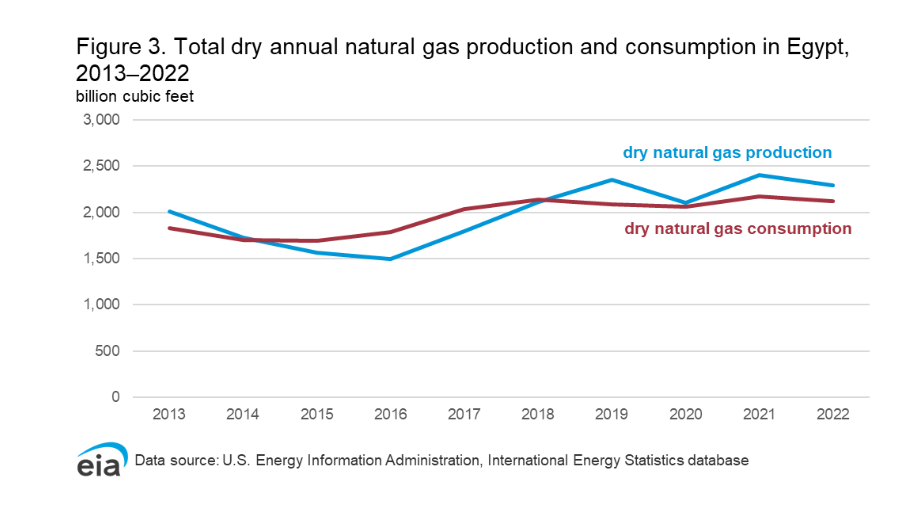

In 2022, Egypt’s energy consumption totaled 4.0 quadrillion British thermal units (quad Btu), with natural gas accounting for 55 per cent of this figure. The country’s energy production was similarly dominated by natural gas, which comprised 62 per cent of the 3.9 quad Btu produced. Egypt’s electricity generation reached 215.8 terawatt-hours (TWh), with natural gas contributing 81 per cent of this total.

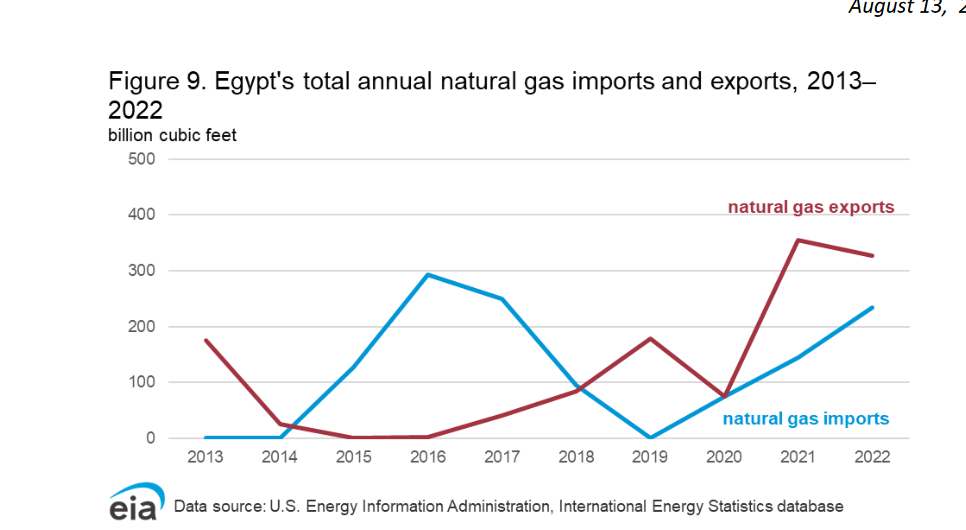

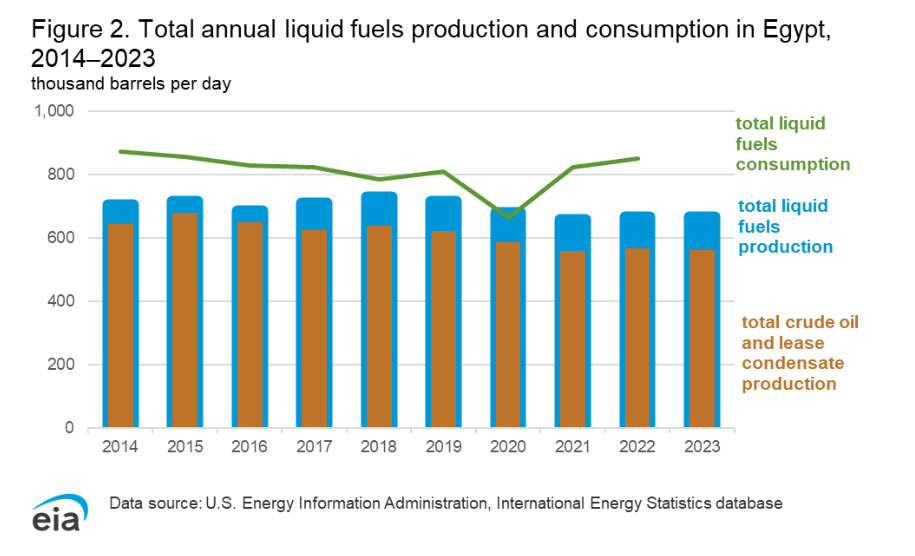

Egypt has seen substantial developments in its energy sector over recent years. It remains a significant hydrocarbon producer, being Africa’s second-largest natural gas producer behind Algeria and the second-largest non-OPEC liquid fuels producer after Angola. Despite this, Egypt faces challenges in its natural gas sector. The Zohr field, a major offshore discovery, has experienced production issues, and recent exploration efforts have not yielded new significant findings. Additionally, domestic natural gas consumption has surpassed production, forcing Egypt to consider imports to meet demand.

The country operates critical infrastructure, including the Suez Canal and the Suez-Mediterranean Pipeline, which are vital for global energy trade. However, recent geopolitical tensions and regional conflicts have impacted Egypt’s energy revenue, especially from LNG transit fees.

Egypt’s energy strategy includes ambitious plans to boost renewable energy. By 2035, the government aims to have 42 per cent of its electricity capacity from renewable sources, up from 20 per cent in 2022. In 2023, agreements were signed to develop significant wind and solar power projects, potentially adding up to 20 GW to Egypt’s renewable capacity.

On the nuclear front, Egypt’s first nuclear power plant is under construction in El Dabaa, with the first reactor expected to come online by 2026 and all four reactors operational by 2030.

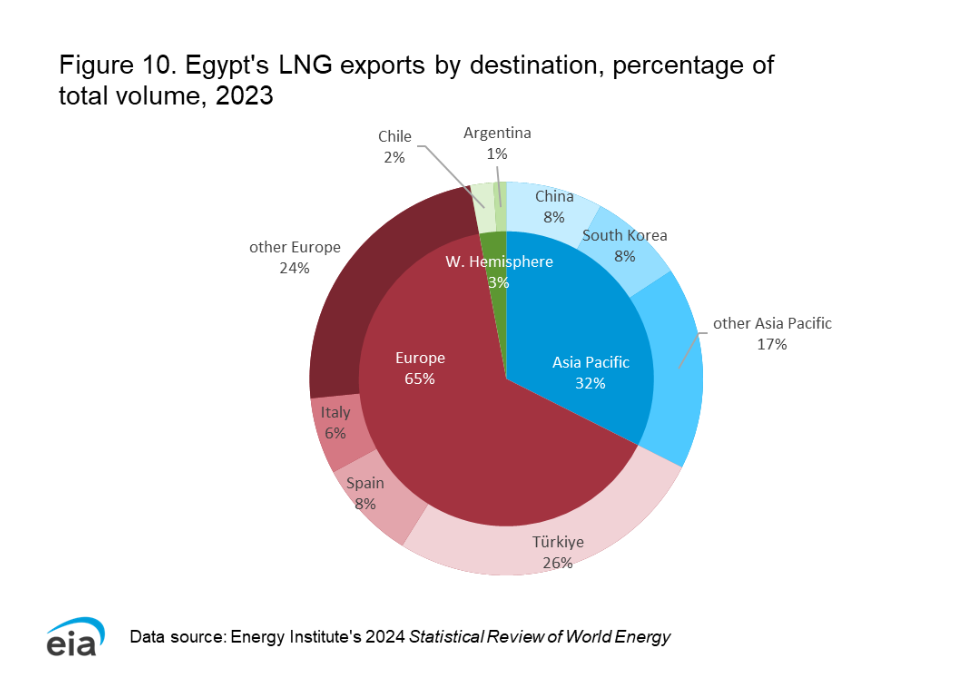

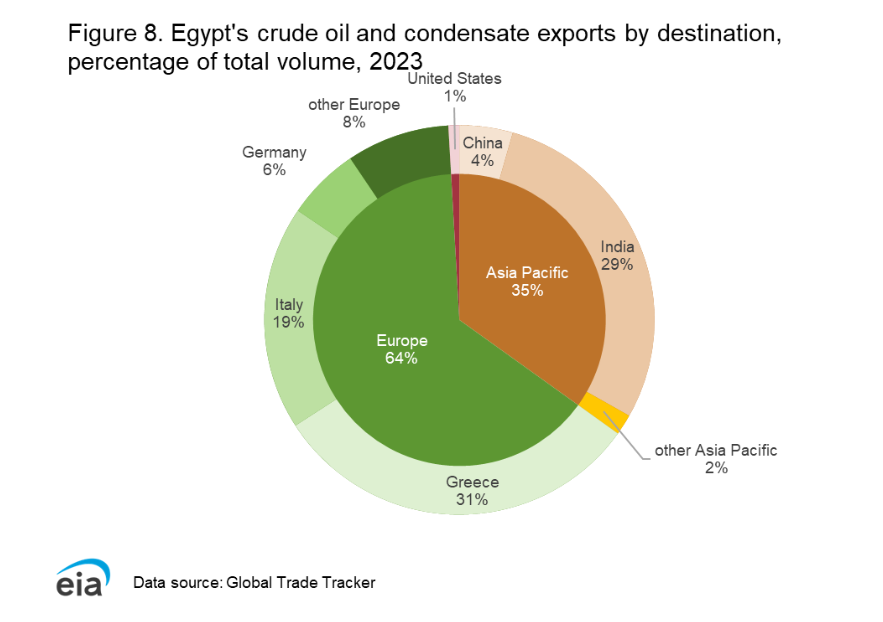

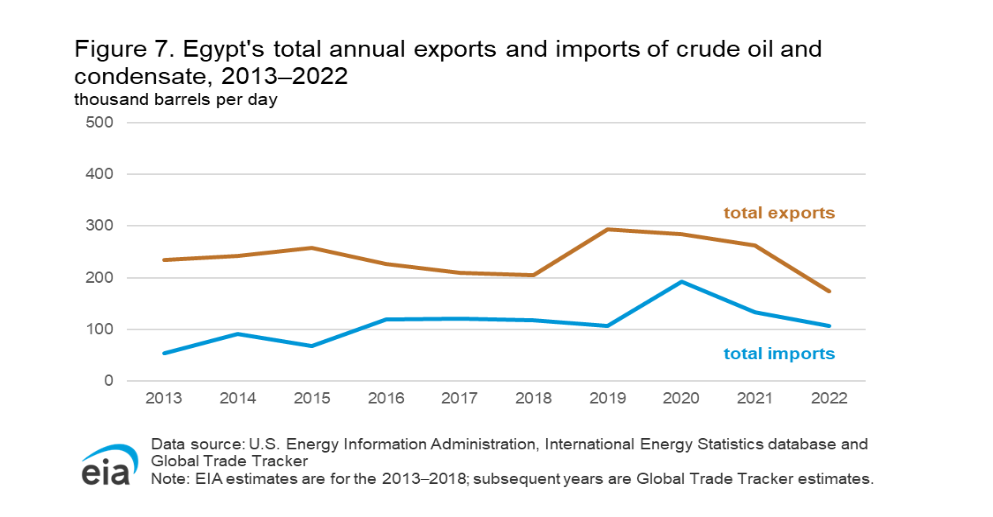

In terms of energy trade, Egypt has seen fluctuations in its crude oil and LNG exports. In 2023, Egypt exported around 166,000 barrels per day (b/d) of crude oil, primarily to Europe and Asia. Meanwhile, natural gas exports reached 173 billion cubic feet (Bcf), with major buyers including Turkey, Spain, South Korea, and China.

Despite the progress, Egypt faces challenges in balancing domestic consumption with export ambitions. The country’s ongoing development of energy infrastructure and strategic projects will be crucial in addressing these issues and achieving its long-term energy goals.

Attribution: US Energy Information Administration (EIA)Country Analysis Brief Egypt

Subediting: Y.Yasser