A new report, the Green Central Banking Scorecard produced by Positive Money, has ranked the G20 countries based on their central banks’ progress in incorporating environmental considerations into their operations. The EU and a number of member states; France, Germany, and Italy have emerged as leaders in this area, while the United States Federal Reserve faces criticism for its lack of action.

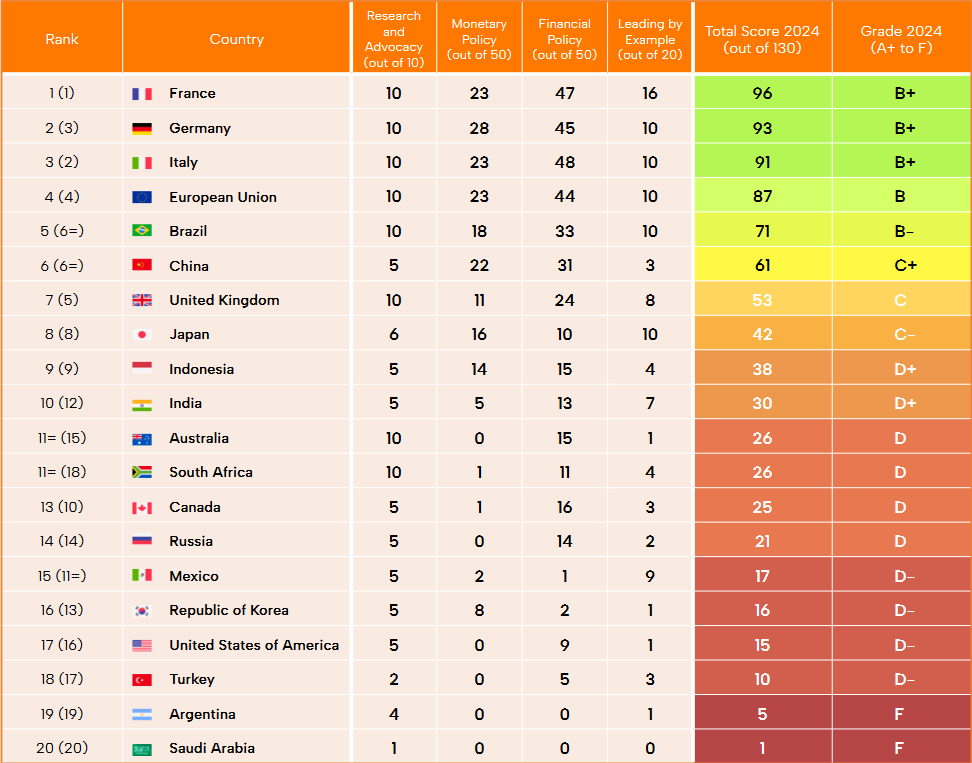

The scorecard, released this month, assesses G20 countries across four categories: Research and Advocacy, Monetary Policy, Financial Policy, and Leading by Example. The rankings are based on literature reviews, expert consultation, and bilateral interactions with the institutions.

Top Performers

EU

The European Union and its member states have taken the lead in green central banking. France, Germany, and Italy have all made significant progress, taking the top three positions on the scorecard. Brazil, China, Japan, Indonesia, India, Australia, and South Africa have shown progress.

France, top of the 2022 scorecard ranking, has remained in first place with a slightly higher score than Germany and Italy, which were positioned second and third, respectively. France, Germany, and Italy, have all been awarded a B+ grade.

Germany has made the most progress, improving its score by 33 points since 2022, moving up one place to overtake Italy, which garnered 30 points. Although France still leads the pack, its progress has been outpaced by its EU peers.

European Central Bank (ECB) has been particularly active, taking steps such as tilting corporate bond holdings towards Paris Agreement-aligned investments and conducting economy-wide climate stress tests.

Brazil

Brazil has also shown progress by achieving a B- grade in 2024 to move from joint 6th position in 2022 to 5th position in 2024. Although Banco Central do Brasil has not fully implemented high-impact policies, its numerous medium-impact initiatives and commitment to a high-impact monetary policy demonstrate progress in line with the scorecard’s recommendations.

“Brazil is therefore making good progress in line with the scorecard project’s recommendations, and is on course to improve its grade further.”

China

China has made progress in green central banking, achieving a C+ grade. The People’s Bank of China (PBoC) has supported green investment through the Carbon Emission Reduction Facility (CERF) and has ceased new coal lending, indicating progress towards greening its operations. However, existing large-scale loans to coal, facilitated by the PBC, remain unresolved, hindering China’s overall progress and preventing it from achieving top rankings.

Japan

Japan has shown potential in green central banking, implementing innovative policies like Climate Transition Bonds and Climate Response Financing Operations. A notable policy is the Climate Response Financing Operations, under which the Bank of Japan (BOJ) has extended £35 billion in loans to support private sector initiatives addressing climate change. However, the responsibility for defining ‘green’ criteria was left to private institutions, leading to uncertainties about the programme’s effectiveness. Consequently, the full potential of the Bank of Japan’s green policies remains untapped, and Japan continues to hold the eighth position in the 2024 rankings.

Indonesia

Indonesia, despite its reliance on fossil fuel exports, has made slow but steady progress in green central banking. The Bank of Indonesia has incorporated green considerations into its foreign reserves management and supported green sukuk instruments, contributing to a higher score in the Monetary Policy category.

Other countries

India: Improved its rank from 12th to 10th by committing to several medium-impact policies, such as mandatory disclosures for financial institutions and system-wide stress testing exercises.

Australia: Mixed progress; while the Reserve Bank of Australia has taken minimal action, the Australian Prudential Regulation Authority (APRA) is advancing by considering climate risk in supervision and conducting climate scenario analysis with the five largest banks.

South Africa: Leading role in the NGFS and issuing climate-related guidance for financial firms, but needs to implement medium impact actions beyond NGFS contributions to improve its score further.

Countries that have stalled

The UK: Despite its strong progress in previous years, the UK’s green central banking efforts have stagnated. The UK has maintained its C grade but has not taken any significant new steps towards high-impact monetary policies. It has only carried out a few medium impact policies, most notably the greening of the Bank of England’s Corporate Bond Purchase Scheme.

Canada: The country has experienced a decline in its green central banking ranking, falling from 10th to 14th. The Bank of Canada has failed to move forward on climate-related initiatives, such as incorporating climate considerations into its collateral framework. However, the financial supervisor has mandated climate-related financial risk disclosure.

Countries that are falling behind

Mexico has fallen behind in green central banking. The Banco de México announced plans to incorporate Environmental Social and Governance (ESG) considerations into its foreign reserves management in 2022, but as of July 2024, no concrete actions have been taken.

South Korea’s ranking has declined from 13th to 16th due to its lack of progress in green central banking. While the Bank of Korea has committed to addressing climate change and has established an Office of Sustainable Growth, its efforts have been hindered by the lack of green certification procedures and limited availability of green bonds.

Russia has shown minimal progress in green central banking, maintaining its 14th position and improving its grade slightly from D- to D. While the Central Bank of the Russian Federation (CBRF) has implemented some medium-impact policies, it has failed to follow through on previous commitments and has not taken any significant new steps towards high-impact policies.

The remaining countries — the US, Turkey, Argentina, and Saudi Arabia are the lowest-ranked countries in the 2024 scorecard. Their central banks and supervisors have taken minimal or no action to green their operations, falling far behind the other G20 members in all categories.

US Federal Reserve’s ‘Inaction’

In contrast, the US Federal Reserve has been criticised for its inaction on climate change. Despite its global influence, the report said the Fed had failed to integrate climate considerations into its monetary policy and financial regulation. This lack of action has drawn criticism from environmental advocates and international observers.

“The Fed must go beyond merely acknowledging climate risks: it must join the growing international consensus that green central banking is essential to redirect financial flows towards green activities.” the report read.

“Without decisive action from the Fed, financing the green transition will be significantly more challenging.”

African Union Excluded

The African Union, while a permanent member of the G20 since September 2023, was not included in the 2024 rankings. The report attributed the exclusion to the lack of a central monetary and financial institution that could be assessed in the same manner to the European Central Bank and European Banking Authority (EBA). Assessing the individual policies of all 55 African Union member states is beyond the current scope of the Scorecard project, the report added.

Recommendations

The report proposes 14 recommendations for central banks and supervisors, including three new ones: addressing “climateflation” to achieve inflation targets, coordinating with governments for increased green public investment, and supporting the development of unsustainable taxonomies.

Attribution: The Green Central Banking Scorecard 2024