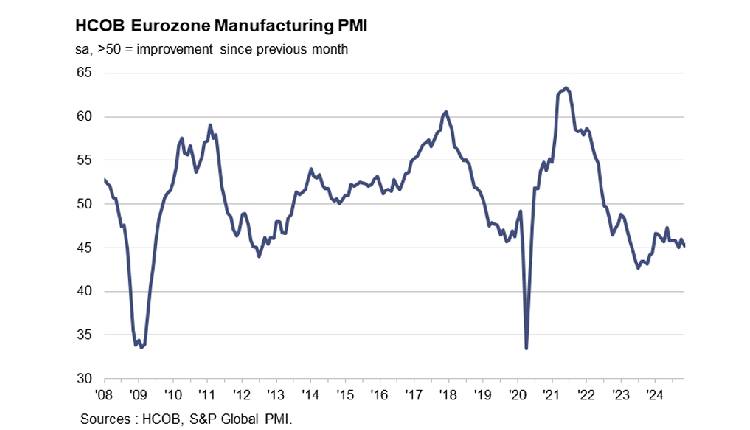

The euro area’s manufacturing sector showed deepening weakness in November, with the HCOB Eurozone Manufacturing PMI falling to 45.2 from 46.0 in October, marking a sharper decline than in previous months.

The reading, below the 50.0 no-change mark for the 16th consecutive month, reflected declines in new orders, production, and employment, with job losses accelerating to their steepest rate since August 2020.

The downturn was most pronounced in Germany, France, and Italy, while Spain and Greece saw slower improvements.

Manufacturers faced intensifying challenges, including a significant drop in new business, particularly in export markets.

The capital goods segment suffered the most, and backlogs of work continued to shrink, highlighting persistent spare capacity. Firms responded by reducing purchasing activity and cutting inventory levels at the fastest rates in nearly a year.

Despite declining input costs and discounts on output prices, business confidence improved slightly but remained low by historical standards.

Economists warned that the sector’s slump, which has lasted since July 2022, is likely to persist into 2024, with output forecasted to shrink by 0.7 per cent in the fourth quarter.

Attribution: S&P Global

Subediting: M. S. Salama