European asset manager Amundi SA is close to finalising a sale of business parks to Blackstone Inc. for €250 million to €300 million as it grapples with investor withdrawals from its property funds. Blackstone plans to convert these properties into logistics facilities for better returns.

This sale highlights challenges for open-ended property funds in Europe, which manage around €166 billion in assets. With office buildings falling out of favour, funds are forced to sell more attractive assets like residential buildings and warehouses to meet redemption requests. This strategy increases their exposure to less desirable segments and may delay market recovery.

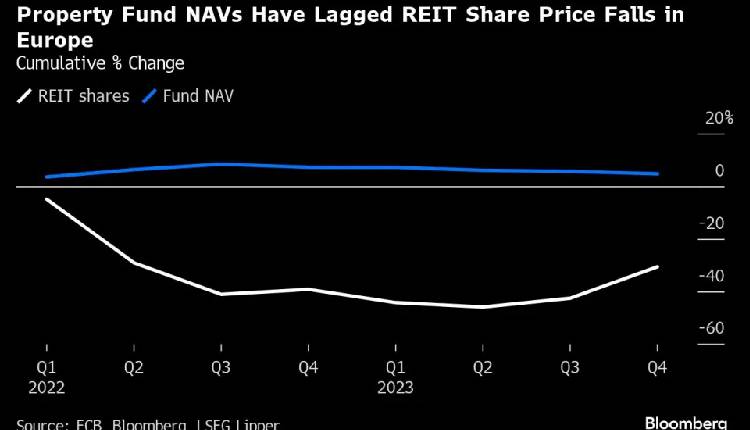

European property funds have faced six consecutive quarters of outflows, with over €12 billion withdrawn since July 2022. Unlike mutual funds, property funds deal in large, illiquid assets, making quick sales difficult and often leading to significant discounts.

In Germany, funds struggle with regulatory rules that prevent selling assets below book value, leading some to explore new credit lines. The European Central Bank (ECB) has warned that property fund issues could worsen a market downturn, potentially impacting the global economy.

The discrepancy between reported and actual asset values remains significant, especially for office buildings. Deutsche Bank recently increased its reserves for loan losses, reflecting broader concerns in the commercial real estate sector.

Despite the difficulties, some investors are eyeing distressed assets for potential buying opportunities, though a planned IPO for a UK real estate trust was shelved due to insufficient funds.

Attribution: Bloomberg.