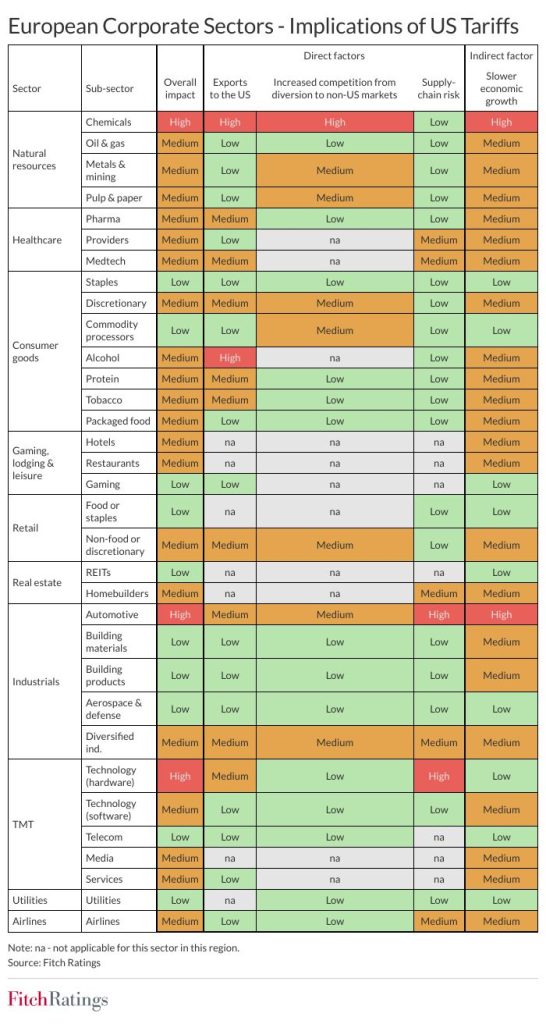

Newly imposed US tariffs—20 per cent on EU goods and 10 per cent on UK imports—will dampen revenue and profit growth across several European corporate sectors, Fitch Ratings warned.

The chemical, automotive, and technology hardware sectors are expected to bear the brunt, with the chemical industry facing increased global competition and pressure from weak demand due to slowing growth in the US, Europe, and China. EU-based automotive manufacturers are vulnerable to supply chain disruptions and softer global demand, while telecom equipment producers will contend with higher localisation costs in the US.

Alcohol producers may experience short-term pressure on US exports, especially in the mass and mid-price segments, while premium brands are expected to show greater resilience. Meanwhile, consumer-facing sectors—such as hospitality, non-essential retail, and airlines—could see reduced demand due to weaker purchasing power in both the US and Europe.

Diversified industrials with US operations will still feel the impact through affected exports and intermediate goods imports, while heightened competition from Chinese firms may further erode market share. Healthcare providers and medical technology firms could suffer from lower US consumer spending, though pharmaceuticals remain temporarily exempt from tariffs.

Fitch also flagged that the metals, mining, and oil and gas sectors will be pressured by slowing global growth, with energy prices under threat despite potential supply management from OPEC+.

Attribution: Amwal Al Ghad English

Subediting: M. S. Salama