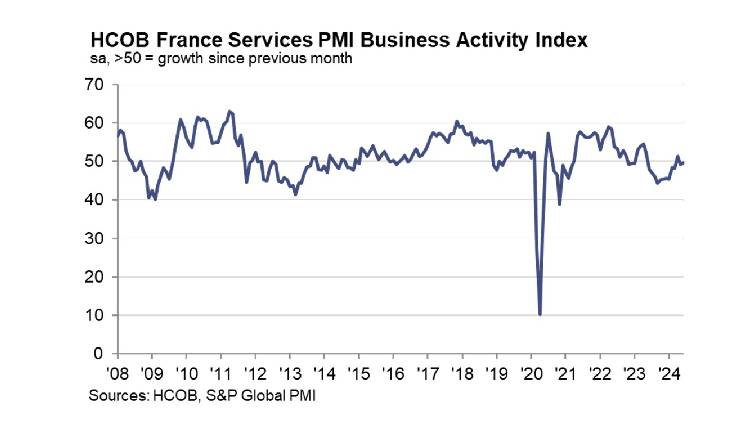

The HCOB France Services PMI Business Activity Index remained below the critical 50.0 threshold in June for the second consecutive month, indicating a decline in activity compared to May.

The index did see a slight increase from 49.3 to 49.6, suggesting a continued marginal contraction.

These back-to-back declines effectively nullified April’s modest growth, leaving France’s service sector broadly stagnant across the second quarter.

The reduction in output was primarily attributed to lower footfall and weaker sales, with some businesses also pointing to the general election as a factor impacting June’s activity.

For the first time in three months, demand for French services fell at the end of Q2. Survey respondents noted a significant reduction in client numbers, leading to the sharpest decline in new business since January.

A major contributing factor was the substantial drop in export demand, which contracted markedly for the fourth consecutive month.

Norman Liebke, Economist at Hamburg at Hamburg Commercial Bank, said: “Election uncertainty stalled the French services sector in June. The HCOB Business Activity Index showed a little improvement compared to the previous month but still stayed below 50, signalling contraction. Some panel members linked

the drop in business activity to election-related uncertainty.”

“It’s thinkable that the upcoming elections were the decisivefactor, particularly because new orders have suddenly dropped. French service companies completed more backlogs of work in response to weaker demand, which explains the gap between the indices for output and new orders.”

“Upcoming elections have made service providers less optimistic about future activity. In addition to business confidence being at a five-month low, it is also clearly below its historic average. In accordance with this, employment growth weakened.”

“Service prices inflation continues to ease but still poses a risk. The latest rise in input prices was historically high, with companies noting greater salary costs and raw material price increases. On the other hand, output prices in the French service sector edged further towards the neutral threshold, meaning that companies did not fully pass on higher input costs to clients. According to anecdotal evidence, some companies were able to offer discounts due to lower interest rates.” Liebke concluded.

Attribution: HCOB, S&P Global PMI