Indian government bonds eligible for index inclusion received record overseas inflows last week, indicating that the central bank’s restrictions on the securities have not deterred investor interest.

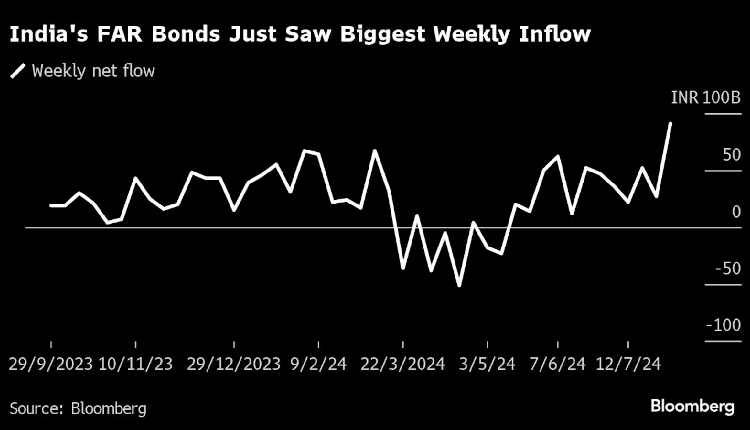

Offshore investors purchased 90.9 billion rupees ($1.1 billion) of fully accessible route bonds in the week ending Aug. 2, a significant increase from the 27.6 billion rupees in the previous week, according to data from the Clearing Corp. of India.

This influx of capital comes despite the Reserve Bank of India’s (RBI) recent decision to restrict access to new 14-year and 30-year government bonds.

The central bank’s move was aimed at curbing potentially volatile hot money inflows associated with the inclusion of Indian debt in a major global index.

Foreign portfolio investors continue to show a preference for five- to 10-year bonds, which has kept flows stable, as highlighted by Morgan Stanley strategists Nimish Prabhune and Min Dai.

India’s increasing weight in JPMorgan Chase & Co.’s emerging market index, from one per cent to two per cent in June, has also contributed to the inflow of funds.

The country’s weight is set to reach 10 per cent over time, with a gradual increase of one per cent per month.

As a result of these factors, foreign ownership of FAR bonds has climbed by 18 basis points to 5.1 per cent of the total outstanding.

Morgan Stanley expects foreign inflows into Indian bonds to accelerate further in the coming months, driven by growing anticipation of a Federal Reserve interest rate cut.

Attribution: Reuters