The Securities and Exchange Board of India (SEBI) is set to broaden its sustainable finance framework to encompass a wider range of products, potentially boosting the country’s ESG-labeled debt market.

The regulator is proposing the inclusion of social bonds, sustainable bonds, and sustainability-linked bonds in addition to the existing environmental, social, and governance (ESG) debt instruments.

The plan also involves introducing eligible asset-backed securities and mandating independent external reviews for all ESG debt, according to a consultation paper released on Friday.

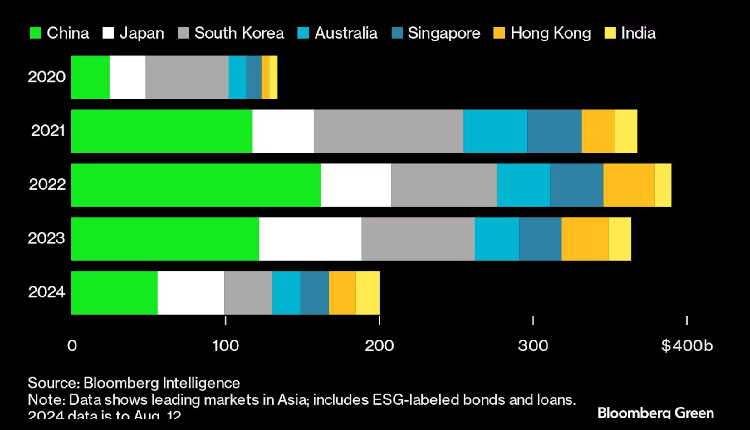

India’s ESG debt issuance has already seen significant growth, reaching $15.6 billion this year, surpassing the previous record set in 2021. However, the country still lags behind major Asian markets like China and Japan.

The proposed changes aim to expand the scope of eligible activities for ESG debt issuance beyond environmental sustainability, such as renewable energy and water management. The consultation period will remain open until September 6.

If the consultation leads to changes in the current framework, Sebi will have the authority to regulate onshore bonds. Several prominent Indian companies, such as Adani Group subsidiaries, have started issuing sustainability-linked and social bonds in foreign currencies through private placements or listings abroad.

Attribution: Bloomberg

Subediting: M. S. Salama