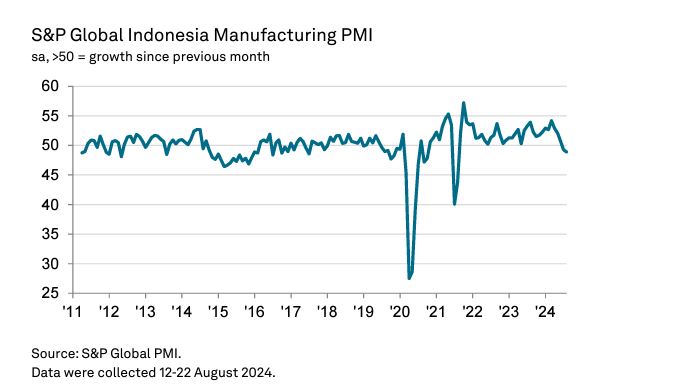

Indonesian manufacturing sector experienced a sharp decline in August 2024 with the S&P Global Manufacturing Purchasing Managers’ Index (PMI) dropping to 48.9, the lowest since August 2021.

In August, there were simultaneous declines in manufacturing production and new orders, with the sharpest contraction since August 2021. Panellists noted softer market demand compared to July as the main reason for the decrease in new orders.

The drop in foreign orders also accelerated to the highest level since January 2023. In addition to weaker export demand, some panellists mentioned that global shipping challenges were impacting sales.

Job shedding occurred at Indonesian manufacturing plants due to weaknesses in production and new orders. Overall, headcounts decreased slightly for the second consecutive month.

Some firms did not replace employees who left or implemented temporary layoffs due to slow sales and production. Workloads were manageable, with backlogs decreasing for the third consecutive month.

Companies reduced their purchasing activity and used inventories more in August 2024. Input stocks fell for the first time in a year-and-a-half, while finished goods stocks rose for a second month. Manufacturers were surprised by the weak sales.

“The downturn in Indonesia’s manufacturing economy intensified during August, characterised by the steepest falls in both new orders and output for three years. Unsurprisingly, firms responded by cutting headcounts, although many were keen to note these were temporary in nature. This likely reflects some confidence that operating conditions will improve, and confidence overall remains positive despite softening a little since July.” Paul Smith, Economics Director at S&P Global Market Intelligence, said.

“Amid some reports of ongoing global shipping challenges, input prices are still increasing to an elevated degree although inflation continued to steadily soften, reaching a ten-month low in August.”

Attribution: S&P Global Indonesia Manufacturing PMI report

Subediting: Y.Yasser