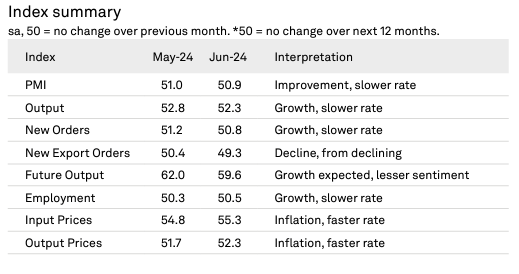

The JP Morgan Global Manufacturing PMI posted 50.9 in June, down slightly from May’s high of 51.0 but still above the neutral 50.0 mark for the fifth consecutive month, indicating improved operating conditions.

4 out of the 5 PMI sub-indices showed expansion, with increases in output, new orders, and employment, and lengthening suppliers’ delivery times. However, stocks of purchases decreased for the fourth month.

Global manufacturing production growth held steady, with output rising for the sixth consecutive month. Consumer and intermediate goods saw growth, while investment goods production declined for the second time in three months.

Moreover, 18 nations, out of the 30 nations surveyed, saw output increases, particularly in Asia, with strong performances from India, Vietnam, and Thailand. The euro area remained weak, with output falling for the fifteenth consecutive month, despite growth in Spain, the Netherlands, and Greece. The US, UK, and Brazil continued to see upturns.

New business rose for the fifth month, though at a slower rate, and new export orders fell for the first time in three months. Business optimism dipped to an eight-month low.

Manufacturing employment rose for the third time in four months, with notable job creation in the US, Japan, India, and Brazil. Input buying increased slightly, while stocks of purchases and finished goods fell.

Moreover, supply chain pressures were relatively mild, despite global shipping disruptions. Manufacturing input costs rose at the highest rate in 16 months, driving up factory gate prices. Price increases were generally higher in developed nations compared to emerging markets.

Attribution: JP Morgan Global Manufacturing PMI report.