The global economy is showing signs of improvement as inflation declines and trade growth strengthens, according to the Organisation for Economic Co-operation and Development’s (OECD) latest Interim Economic Outlook. Despite persistent risks, growth remained resilient in the first half of the year.

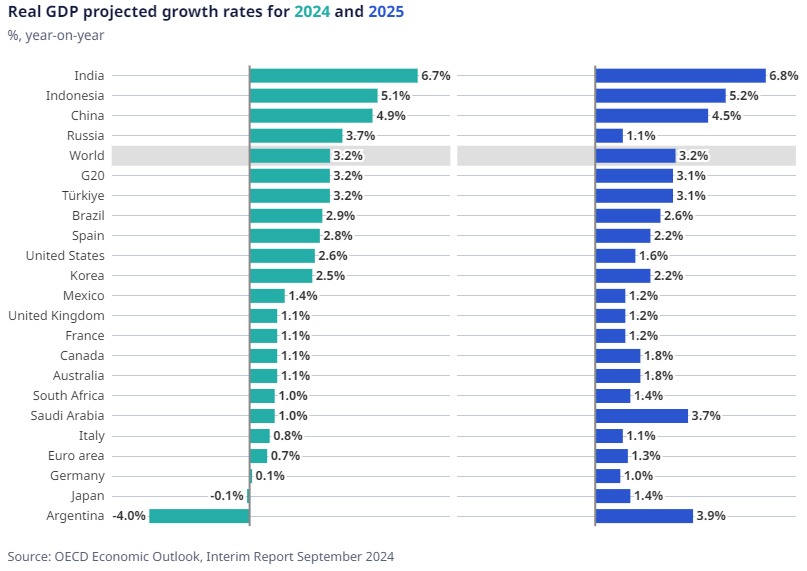

The OECD projects global economic growth to remain steady at 3.2 per cent for both 2024 and 2025, following a growth rate of 3.1 per cent in 2023. This outlook is supported by strong trade growth, rising real incomes, and more accommodative monetary policies across multiple economies.

Headline inflation in the G20 economies is expected to decrease from 6.1 per cent in 2023 to 5.4 per cent in 2024 and further to 3.3 per cent by 2025. Core inflation in advanced G20 economies is forecast to ease to 2.7 per cent in 2024 and 2.1 per cent in 2025. The OECD anticipates inflation will return to central bank targets in most G20 economies by the end of 2025.

The report forecasts that the United States will experience slower GDP growth, with an expected rate of 2.6 per cent in 2024 and 1.6 per cent in 2025, moderated by easing monetary policies.

The euro area is projected to see modest growth of 0.7 per cent in 2024, increasing to 1.3 per cent in 2025, driven by improving real incomes and better access to credit. In China, growth is expected to slow to 4.9 per cent in 2024 and 4.5 per cent in 2025, due to weak consumer demand and ongoing challenges in the real estate sector.

OECD Secretary-General Mathias Cormann highlighted the need for continued cautious monetary policy, stating, “The global economy is starting to turn the corner, with declining inflation and robust trade growth. At 3.2 per cent, we expect global growth to remain resilient both in 2024 and 2025.”

Cormann emphasised the importance of rebuilding fiscal space through more efficient public spending, reallocating resources towards growth-promoting sectors, and optimising tax revenues. He called for structural reforms to boost medium-term growth, particularly through pro-competition policies that lower regulatory barriers in services and network industries.

However, risks remain, particularly from potential financial market disruptions caused by deviations from the expected disinflationary path. Geopolitical tensions, such as Russia’s war in Ukraine and conflicts in the Middle East, could also push inflation higher and weigh on global economic activity. On the upside, stronger real wage growth and weaker global oil prices may further support economic recovery.

Attribution: OECD Economic Outlook, Interim Report Turning the Corner

Subediting: M. S. Salama