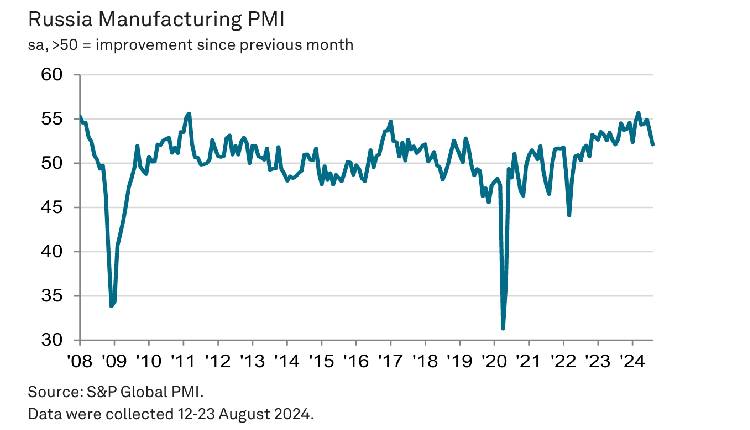

Russian manufacturing firms continued to show improvement in operating conditions in August 2024, according to the latest PMI data from S&P Global.

The Manufacturing Purchasing Managers’ Index (PMI) posted 52.1, down from 53.6 in July, indicating a moderate upturn but the slowest growth since August 2023.

Output, new orders, and employment grew, but at a slower pace, while job creation weakened despite a rise in backlogs of work, driven by longer input delivery times and declining vendor performance.

The pace of input buying slowed, and inventories were further depleted as business confidence dropped.

Cost inflation eased notably, dipping below the series average, leading firms to moderate the pace of increase in selling prices. The rate of input price inflation was the slowest since February 2023.

New export orders saw modest growth, the fastest in a year, following a slight contraction in July. However, the overall rise in new orders was modest, with the slowest growth since October 2022.

Employment growth was slight, the slowest in the current seven-month expansion sequence. Despite this, backlogs of work grew after two months of contraction, hampered by input delivery delays.

Supplier delivery times lengthened markedly due to logistics issues and transport congestion. Firms reported a softer increase in cost burdens, with some raw materials moderating in cost despite currency movements pushing up imported goods prices.

Output charge inflation eased for the second month but remained historically high as firms passed higher costs to customers.

Input buying rose at a slower pace, with firms adjusting purchasing to match new order inflows. Both pre- and post-production inventories fell at slower rates.

Despite stronger-than-average confidence, Russian manufacturers showed lower optimism for the year ahead, focusing on new product launches and advertising to attract customers.

Attribution: S&P Global

Subediting: M. S. Salama