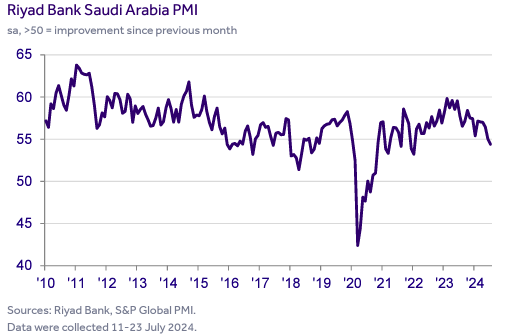

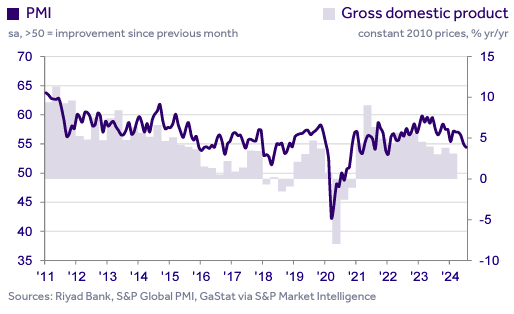

Saudi Arabia’s non-oil private sector showed improvement at the beginning of the third quarter of 2024, as indicated by the Riyad Bank Saudi Arabia Purchasing Managers’ Index (PMI). However, growth softened with the PMI dropping to 54.4 in July from 55.0 in June, marking the lowest level since January 2022.

Key findings revealed the weakest rise in new orders in two-and-a-half years, with output growth easing to a six-month low. Intense competition forced businesses to cut selling prices at a record pace despite rising input costs. Purchasing activity rose, and employment numbers increased for the third consecutive month, though only modestly.

Naif Al-Ghaith, Chief Economist at Riyad Bank, highlighted that demand remains strong despite competitive pressures, supporting growth in the private sector. He noted the expansion in non-oil exports, indicating successful penetration into international markets and aiding economic diversification away from oil dependency.

Modifying input prices and staff costs has helped stabilise output prices, easing inflationary pressures.

Despite the challenges, businesses reported favourable demand conditions, leading to higher sales and improved output. However, firms cited greater market competition and capacity pressures due to a heatwave as factors impacting growth. Higher client demand, robust work pipelines, and increased government investment supported the positive outlook.

The Riyad Bank Saudi Arabia PMI is based on a weighted average of five indices: new orders, output, employment, suppliers’ delivery times, and stocks of purchases. Data were collected from July 11-23, 2024.

Attribution: Riyad Bank Saudi Arabia Purchasing Managers’ Index (PMI)