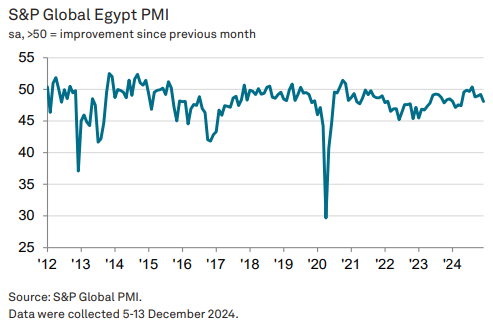

Egypt’s non-oil private sector contracted sharply in December 2024, with the S&P Global Egypt headline PMI falling to 48.1 from 49.2 in November, marking the steepest decline since April and the fourth consecutive month of contraction. This downturn was primarily driven by subdued client demand and rising costs.

Currency

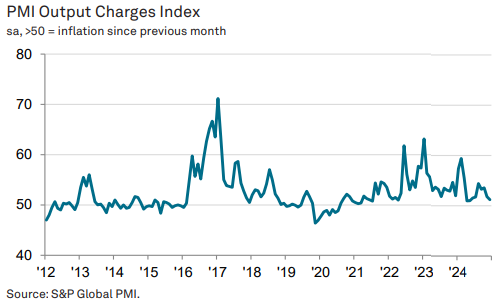

The depreciation of the Egyptian pound, which breached the 50-per-dollar mark in early December, intensified input cost inflation to its highest level in three months. However, as firms faced challenges in achieving sales growth, output prices were increased at the slowest rate since last May..

Sector-Specific Performance

The construction and wholesale and retail sectors recorded the most significant downturns, while the services sector remained relatively stable, supported by steady new business levels. Purchases of new inputs increased, but only in the manufacturing and services sectors.

Declining Inventories and Employment

Total inventories fell for the first time in six months as firms reduced stock levels to manage rising purchasing costs. Employment also declined for the second consecutive month, primarily due to non-replacement of departing staff, even as salary costs rose.

Cautious Optimism for 2025

Despite ongoing challenges, businesses expressed cautious optimism for 2025, citing hopes for improved domestic and geopolitical conditions.

Attribution: Amwal Al Ghad English

Subediting: M. S. Salama