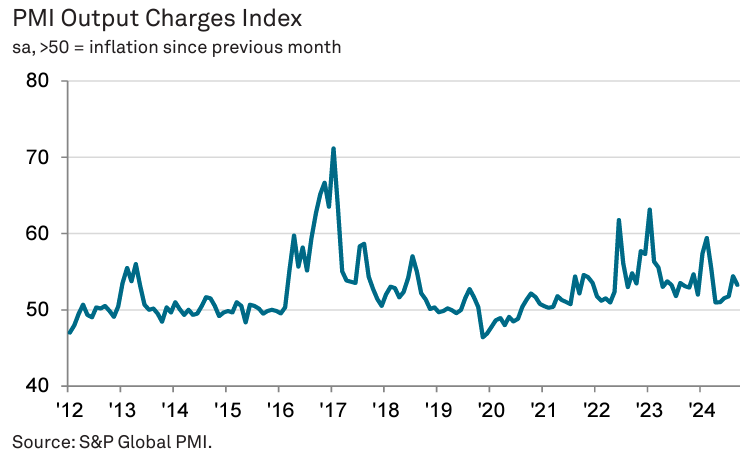

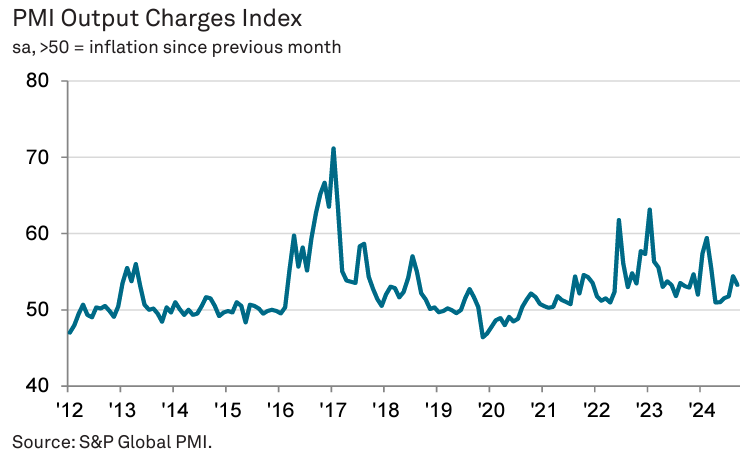

Egypt’s non-oil private sector saw a downturn in September, as the S&P Global Egypt Purchasing Managers’ Index (PMI) dropped to 48.8, signalling a renewed decline in business conditions.

The fall below the neutral 50.0 mark came after a brief period of growth in August, which had been the first expansion since November 2020. The September reading marked the sharpest contraction in new orders and output since April, driven by increased price pressures and weakening customer demand.

Input cost inflation surged to a six-month high, leading companies to raise output prices, further hampering sales, particularly in the domestic market. Despite the economic challenges, some firms maintained optimism, reflected in continued hiring and increased purchasing activity.

Employment numbers rose for the third consecutive month, especially in the construction and retail sectors, while purchases remained steady.

David Owen, Senior Economist at S&P Global Market Intelligence, noted that rising costs hindered the non-oil sector’s recovery. However, the growth in employment and purchases signalled that businesses still hoped for a recovery in the coming months.

Attribution: S&P Global Egypt PMI September

Subediting: M. S. Salama