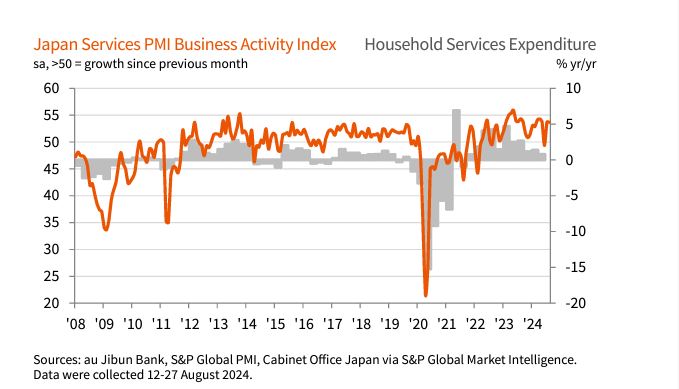

Japan’s service sector continued its solid expansion in August, with the rate of growth remaining steady compared to July, according to a report published by S&P Global on Wednesday.

The au Jibun Bank Japan Services Business Activity Index held steady at 53.7 in August, showing continued growth. Activity has expanded for 23 out of the last 24 months, driven by increased demand and business expansion.

Additionally, prices-driven inflation decreased further from a ten-year high in April to the lowest level since November 2023, despite a continued increase in average cost burdens.

Total new work increased for the second consecutive month in August, with new store openings and growing confidence in domestic markets driving this growth. Export sales also contributed to the overall business performance.

Service providers continued to expand their workforce for the eleventh consecutive month in August, albeit at a slower pace compared to earlier in the year. Anecdotal evidence indicated that efforts to fill open positions were hindered by retirements.

Despite growing demand, firms were able to reduce their backlog of work for the second time in three months, thanks to increased productivity. The rate of reduction was modest but the most significant since April 2022.

Service sector companies remained optimistic about their business prospects for the next 12 months, although the degree of optimism moderated from July. Nevertheless, it remained stronger than the long-run series average.

The au Jibun Bank Japan Composite PMI Output Index registered 52.9 in August, up from 52.5 in July. This indicated moderate growth, the most pronounced since May 2023.

Attribution: S&P Global report

Subediting: M. S. Salama