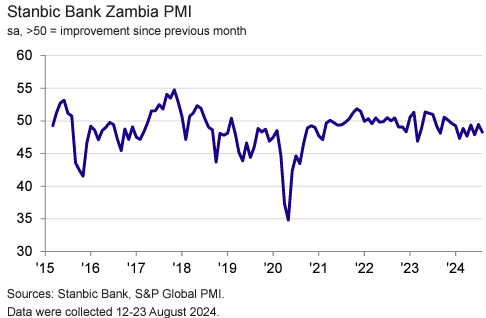

Zambia’s private sector business conditions declined significantly in August 2024, with the Stanbic Bank Zambia PMI falling to 48.3 from 49.4 in July. This drop indicates a continued contraction, driven by reduced activity, decreased new orders, and lower employment. Load shedding continued to strain capacity, resulting in increased backlogs of work.

The PMI reading below 50.0 signals deterioration. New orders decreased for the eighth time in the last nine months, influenced by lower customer purchasing power, ongoing load shedding, and rising costs. This led to a further reduction in output, though the pace of contraction eased to its slowest in three months. Only the manufacturing sector saw increased activity.

Despite a decline in employment and a fifth consecutive rise in backlogs, Zambian firms increased input buying due to supply concerns and anticipated future cost increases. Purchase and staff cost inflation rates softened, with purchase costs rising at the slowest pace in four months and staff costs at their slowest in five months. Selling prices increased at the weakest rate in four months.

Mark P. Katemangwe, Head of Trading at Stanbic Bank Zambia Ltd, commented, “Challenges persist in Zambia’s private sector. New business fell due to load management constraints, with moderate decreases influenced by reduced customer purchasing power and higher costs.”

Firms remain cautiously optimistic about future output, hoping for stabilisation in the dollar exchange rate and energy supply, although confidence has declined for the third consecutive month.

Attribution: Stanbic Bank Zambia PMI®

Subediting: M. S. Salama