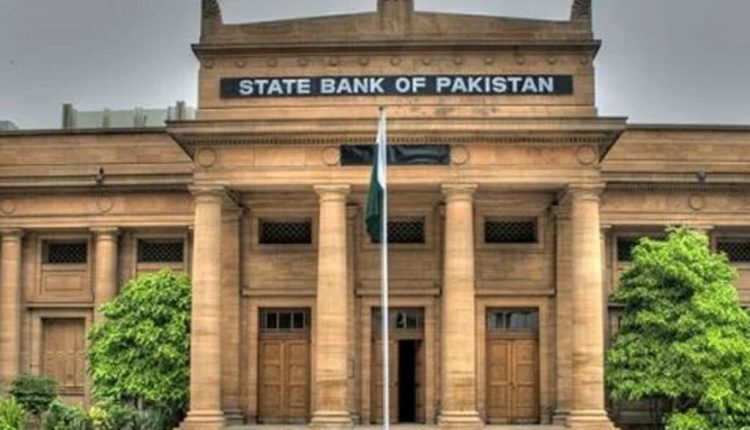

Th State Bank of Pakistan’s (SBP) Monetary Policy Committee (MPC) on Monday decided to cut the policy rate by 100 basis points to 19.5 percent, effective July 30, 2024. The decision comes against a backdrop of moderating inflation, improved external account conditions, and progress on the International Monetary Fund (IMF) programme.

“The (MPC) Committee observed that the June 2024 inflation was slightly better than anticipated. The Committee also assessed that the inflationary impact of the FY25 budgetary measures was broadly in line with earlier expectations.” the bank’s MPC statement read.

“The external account has continued to improve, as reflected by the build-up in SBP’s FX reserves despite substantial repayments of debt and other obligations. Considering these developments – along with significantly positive real interest rate – the Committee viewed that there was a room to further reduce the policy rate in a calibrated manner to support economic activity, while keeping inflationary pressures in check.”

Pakistan’s current account deficit narrowed sharply in FY24 and SBP’s FX reserves improved significantly from $4.4 billion at the end of June 2023 to above $9.0 billion. However, the central bank emphasised the importance of continued fiscal consolidation and the realisation of planned external inflows to support macroeconomic stability.

On July 12, the country reached a staff level agreement with the IMF for a 37-month EFF programme of about $7.0 billion.

While inflation remains a concern, the MPC believes that the current stance is sufficiently tight to guide it towards the medium-term target of 5-7 per cent.

Despite a projected slowdown in agriculture growth, the MPC anticipates a recovery in the industry and services sectors, leading to an estimated GDP growth of 2.5 to 3.5 percent for the fiscal year 2025.

The central bank remains cautious about inflationary pressures and has stressed the importance of achieving fiscal consolidation and addressing structural weaknesses in the economy.

Attribution: The State Bank of Pakistan