The non-oil private sector’s growth in the UAE continued to decelerate in mid-2024, according to the latest PMI® business survey. Despite a modest improvement in sector performance, sustained competitive pressures, weaker job creation, and easing output growth contributed to the softest upturn since February 2023.

According to the survey, the aftermath of April’s floods and supply-chain disruptions due to the Red Sea crisis continued to impact business conditions. Outstanding work increased significantly, reflecting ongoing challenges. Input prices also surged sharply, resulting in the quickest rise in average prices charged since April 2018.

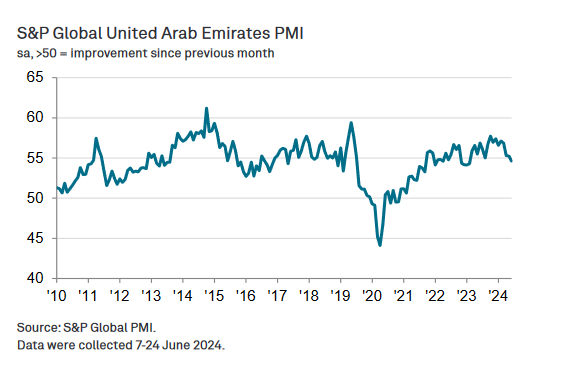

The seasonally adjusted S&P Global UAE Purchasing Managers’ Index™ (PMI) fell to 54.6 in June, down from 55.3 in May. While still above the neutral mark of 50.0, this reading marked the lowest point in 16 months.

Despite a marked increase in business activity, with over a quarter of companies reporting output growth, the rate of expansion was the softest since early 2023. Competitive pressures hindered operations for several firms.

Companies experienced a steep rise in new work during June, reaching the strongest level since March. Improving demand levels and new client acquisitions contributed to this trend. Export volumes witnessed the sharpest uplift since October last year.

Backlogs of work continued to accumulate, albeit at a slower pace than in May. Factors such as strong demand and the lingering impact of floods and the Red Sea crisis limited firms’ capacity. Speedier raw material supply partially eased the backlog accumulation.

The non-oil companies faced a sharp rise in input costs, resulting in the highest inflation rate seen in nearly two years. Material costs, shipping fees, and overheads contributed to price increases. Selling charges were raised for the second consecutive month, reflecting cost pressures.

Despite challenges, UAE non-oil companies remained optimistic about future activity levels. Demand prospects supported increased input buying, leading to faster inventory expansion. Employment numbers rose, albeit at a slower rate due to cost considerations.

Commenting on the survey insights, David Owen, Senior Economist at S&P Global Market Intelligence, highlighted the sector’s slowing growth throughout 2024. While challenges persist, strong customer demand and robust sales pipelines continue to sustain output expectations and drive purchasing activity.

“The UAE PMI highlights a slowing growth trend in the non-oil sector throughout 2024 so far, with the headline index having lost roughly three points since last December. Nevertheless, companies are still enjoying strong customer demand and robust sales pipelines, which are sustaining output expectations and driving purchasing activity.” Owen added.

“The recent surge in backlogs of work is also showing signs of easing, a trend that is likely to continue as the country recovers from April’s floods and supply chains adapt to the current situation in the Red Sea. Supplier lead times improved at the strongest rate for eight months, which will be a further boon for businesses.”

“On the negative side, input price pressures are at their strongest for nearly two years, causing firms to raise their output prices for the second month in a row. With reports of swelling competition in some sectors, firms are keen to retain their competitive edge, which makes the latest uptick in prices even more indicative that businesses are feeling the pain on their balance sheets and having to protect their margins.” Owen concluded.

Attribution: S&P Global PMI