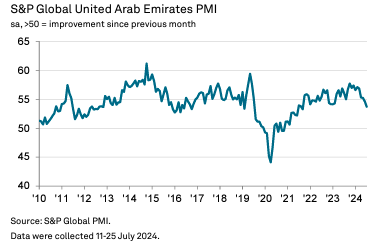

The UAE’s non-oil private sector growth hit its weakest point in nearly three years in July, as the S&P Global UAE Purchasing Managers’ Index(PMI) fell to 53.7 from 54.6 in June, the lowest since September 2021.

The decline in the PMI reflects the challenges posed by rising cost inflation, capacity issues, and competitive pressures. Despite robust customer demand, firms faced increasing workloads and depleted inventories for the first time since late 2020.

Business activity continued to grow, fueled by new projects and improved supply chains, but the expansion rate slowed for the third consecutive month. Notably, international demand saw a significant uptick, though high competition led some firms to experience a drop in new orders.

Input cost inflation surged to a two-year high, driven by increased material and wage costs, resulting in higher output prices for the third consecutive month. Firms dipped into their stocks to manage workload strains, which could hinder growth if inventory levels drop further.

David Owen, Senior Economist at S&P Global Market Intelligence, noted that the PMI’s downward trend signals a deceleration in non-oil sector growth for 2024. He highlighted the sector’s ongoing capacity challenges and the need for firms to manage workloads effectively to sustain growth.

Despite these hurdles, firms remain optimistic about future economic conditions and continued hiring to boost staff capacity.

Attribution: S&P Global UAE Purchasing Managers’ Index (PMI)