The UK government is considering a potential policy to claw back pension tax breaks from asset managers who fail to invest sufficiently in domestic assets, according to Louis Taylor, CEO of state-owned lender British Business Bank.

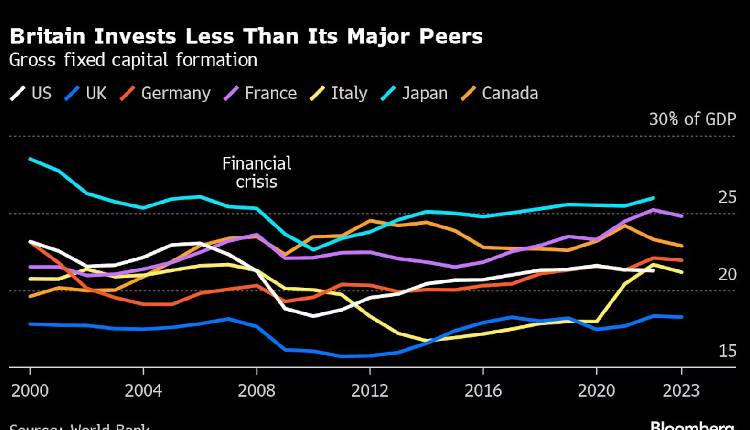

This suggestion, aimed at boosting investment in UK infrastructure and venture capital, comes as the government seeks to address stagnant productivity and underinvestment in the economy.

While not endorsing the measure, Taylor warned that the government could recoup tax reliefs from pension funds that do not allocate enough to the UK.

Prime Minister Keir Starmer’s Labour administration is relying on the private sector to help achieve 2.5 per cent annual economic growth, but pension funds currently allocate only 4.4 per cent of assets to UK stocks, far lower than in previous decades.

Although ministers are hesitant to impose mandatory targets, they hope a voluntary disclosure regime will encourage funds to commit more capital to domestic projects.

Taylor acknowledged the difficulty in balancing investment needs with maintaining the UK’s reputation as an open economy but suggested that more focused investment could significantly support economic growth, particularly in high-risk sectors like venture capital.

Attribution: Bloomberg

Subediting: M. S. Salama