The UK services sector continued its growth trajectory midway through the second quarter, though momentum slowed as expansions in business activity and new orders eased from their 11-month highs in April, according to data released on Wednesday.

The S&P Global UK Services PMI Business Activity Index registered 52.9 in May, down from April’s 55.0, marking the slowest expansion since November last year. Despite this, the index remained above the 50.0 no-change mark for the seventh consecutive month, indicating sustained growth.

New business volumes increased for the seventh month in a row, driven by successful marketing campaigns, greater client confidence, and a boost in inquiries.

However, growth was tempered by subdued overseas demand, with new export orders rising at the slowest rate this year and only marginally overall due to difficulties in dealing with EU customers.

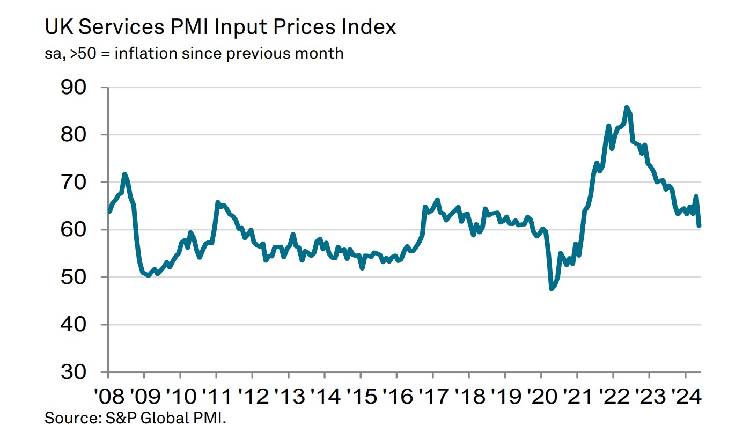

A notable development was the substantial cooling in the rate of input cost inflation, which fell to its weakest since February 2021.

This decrease in input costs led to a softer increase in output prices, with service charges rising at the slowest rate in over three years. Amid reports of sustained salary pressures, higher supplier charges, and increased fuel costs, the overall rate of output price inflation still eased significantly.

The seasonally adjusted S&P Global UK PMI Composite Output Index, which includes both manufacturing and services, fell from April’s one-year high of 54.1 to 53.0 in May, still indicative of solid expansion in private sector economic activity.

Both sectors showed growth, with service firms driving higher output and new orders.

Employment growth accelerated across the UK private sector, reaching a four-month high, primarily due to increased hiring in the services sector, while factory jobs dipped. Business confidence also improved, remaining well above its long-run average.

Input cost pressures across the UK private sector eased to a 40-month low in May. Subsequently, output charges rose at a softer pace, the weakest since February 2021, reflecting the broader trend of easing inflation pressures.