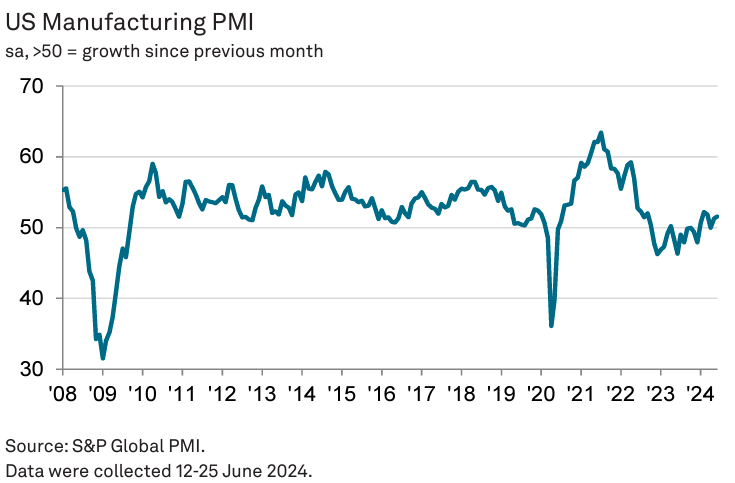

The US manufacturing sector continued to expand in June, with new orders rising for the second consecutive month. The seasonally adjusted PMI edged up to 51.6 from 51.3 in May, indicating a modest improvement in business conditions. Despite this, client demand remained muted and business confidence fell to a 19-month low.

Employment in the sector saw solid growth, marking the fastest increase since September 2022. Firms hired more staff to keep up with higher output requirements and manage workloads, reducing backlogs. However, supply chain delays, including shipping issues and vendor staff shortages, slightly lengthened delivery times and contributed to increased input costs.

Production continued to rise but at a slower pace, reflecting the relatively muted demand environment. While the rate of output growth eased, companies were less optimistic about the 12-month outlook for production.

Some firms expressed expectations of a future pickup in new orders, but overall sentiment dropped to its lowest since November 2022.

Export orders remained broadly unchanged in June, ending a four-month sequence of growth. New business from countries like Canada and Germany increased, but some firms reported lower new orders from mainland China. This mixed international demand further highlighted the challenging economic conditions faced by US manufacturers.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, noted that US manufacturers are struggling to achieve strong production growth due to weak demand from both domestic and export markets. Although the PMI has been in positive territory for five of the first six months of 2024, growth momentum remains weak. Persistent headwinds, including demand shifts from goods to services, higher prices, and economic uncertainties ahead of the presidential election, continue to impact the sector.

Attribution: S&P Global US Manufacturing PMI report.