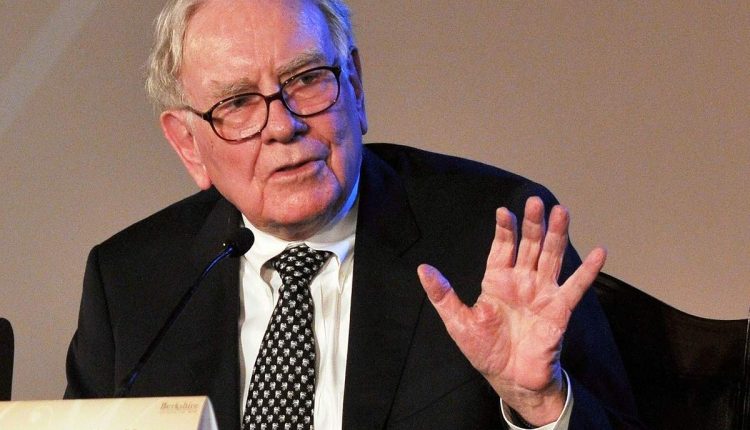

Warren Buffett’s conglomerate sells majority of stake in Goldman Sachs

Warren Buffett’s Berkshire Hathaway sold off 84 percent of its stake in Goldman Sachs during the first quarter, according to a regulatory filing.

The conglomerate slashed its holdings in the investment bank to 1.9 million shares from 12 million shares, according to SEC filings released Friday. Goldman Sachs’s share price plunged by almost a third during the first quarter as the novel coronavirus swept the nation.

Berkshire Hathaway initially invested in $5 billion of preferred stock in the Wall Street firm in 2008, as a vote of confidence in Goldman Sachs at the height of the 2008 financial crisis. It redeemed those shares in 2011, with Berkshire making a profit of $3.7 billion.

A representative of Berkshire Hathaway didn’t immediately respond to a request for comment.

The company remains a majority shareholder in other financial firms, including American Express, Bank of America ,PNC Financialand Wells Fargo\