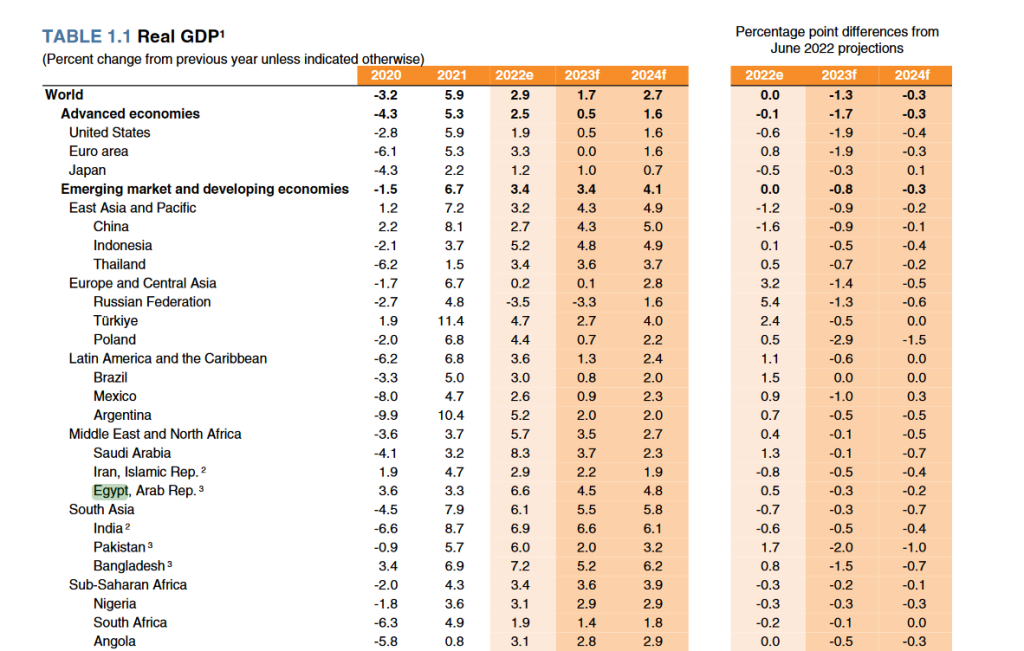

Egypt’s economy is expected to grow 4.5 percent in the financial year 2022/2023, which started last July and ends next June, the World Bank said on Tuesday.

The Bank has previously projected a 4.8 percent growth for Egypt.

According to its latest Global Economic Prospects report, the World Bank said high inflation, weakening external demand in Egypt’s manufacturing and tourism sectors, fiscal and monetary tightening, its “large” current account deficit, and potential trade disruption from “rules governing sourcing of foreign currency” would all work to bring growth down from the estimated 6.6 percent it registered in FY 2021-2022.

“Growth in Egypt, while continuing to benefit from earlier reforms, is expected to slow to 4.5 percent in FY2022/23, as high inflation erodes real wages, weighing on domestic consumption.”

“Weakening growth of external demand is also likely to limit activity in the manufacturing and tourism sectors. Fiscal and monetary policy tightening to rein in high inflation and a large current account deficit are expected to further restrain growth …”

The World Bank said authorities in Egypt are gradually dismantling new import rules to contain balance of payment pressures, “but continued trade disruptions may still occur from, for example, rules governing sourcing of foreign currency.”

Meanwhile, the Bank has also slashed its global growth forecast for 2023 by almost half to 1.7 percent, down from its June prediction of 3.0 percent, on soaring inflation, aggressive policy tightening cycles and other knock-on effects of the Russian war in Ukraine.

The World Bank revised down growth forecasts for 95 percent of advanced economies and around 70 percent of emerging and developing markets, it said in a statement accompanying the report.

“Emerging and developing countries are facing a multi-year period of slow growth driven by heavy debt burdens and weak investment as global capital is absorbed by advanced economies faced with extremely high government debt levels and rising interest rates.” World Bank Group President David Malpass said.

“Weakness in growth and business investment will compound the already-devastating reversals in education, health, poverty, and infrastructure and the increasing demands from climate change.”