The yuan is emerging as a preferred funding currency for carry trades in the global market, following Japan’s shift away from ultra-loose monetary policy and Taiwan’s unexpected rate hike, Bloomberg reported on Monday.

Investors are reevaluating their dollar-funded strategies as the Federal Reserve’s potential easing appears less certain.

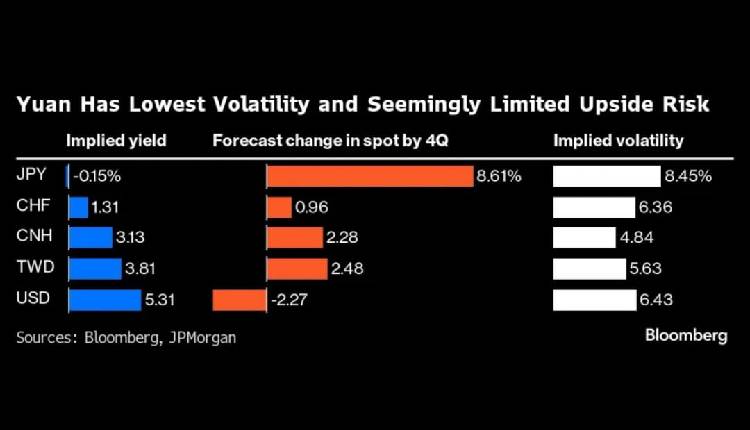

The yuan’s low volatility and the People’s Bank of China’s easing stance make it an attractive option, especially as Bloomberg data shows its appeal over the yen and Taiwan dollar.

The yuan’s one-month implied volatility recently hit a low since 2017, and its offshore interbank interest rates in Hong Kong have dropped to about 3 per cent from 4.5 per cent in September.

Despite the yen’s 6.8 per cent depreciation against the dollar this year, some analysts still find it attractive for carry trades, expecting the Bank of Japan to maintain low rates, with swaps pricing a policy benchmark rise to 0.3 per cent by December.