IMF: Egypt’s central bank may warrant additional policy tightening to curb inflation

Egypt’s central bank (CBE) may warrant additional monetary policy tightening as persistent inflationary pressures mount following the recent depreciation of the local currency, the International Monetary Fund (IMF) report said on Tuesday.

“While the CBE should look through the first-round impact from the commodity price shock, it was agreed that persistent inflationary pressures, including through second round effects or further EGP depreciation, may warrant additional policy tightening.” the report read.

Monetary policy would continue to be data dependent, firmly anchored to the CBE’s price stability mandate, the IMF report added.

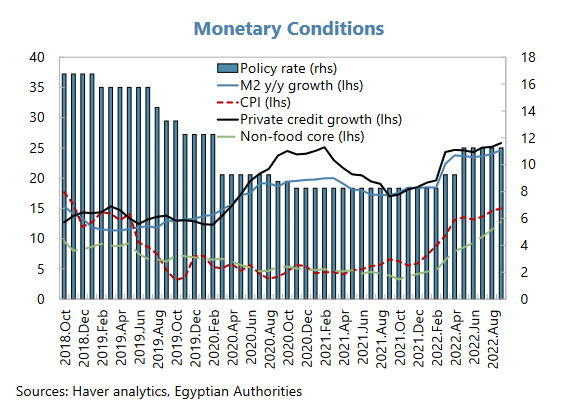

Since March, the CBE has cumulatively hiked interest rates by 500 bps, with the policy rate (overnight deposit) at 13.25 percent as of October and increased the reserve requirements by 4 percent in September. Higher commodity prices and pass-through from exchange rate depreciation have pushed the projected inflation path well above the central bank’s target range of 7 (±2) percent for the fourth quarter of 2022.

“A monetary policy consultation clause (MPCC) is proposed to monitor inflation performance. Reflecting prevailing uncertainty in global price developments and limitations of monetary policy in the very short run, the MPCC bands around a central target of 7 percent are set intentionally wide at the beginning of the Fund-supported program but would narrow over time.”

“If inflation falls outside the inner bands of 5 to 9 percent, the authorities will engage with staff on reasons for the deviation and the CBE’s proposed remedies to restore inflation within the band.” the IMF noted.

In a letter of intent to the IMF dated November 30, the government said: “While inflation is likely to remain high in the near-term, monetary policy will be calibrated to keep inflation expectations well-anchored and reduce inflation back to within the target band of the Central Bank of Egypt (CBE) over the medium-term.

“To help meet our inflation target, we are enhancing the efficacy of the monetary policy transmission mechanism, through transitioning away from subsidized lending schemes and ensuring that the interbank rate remains steadfastly tied to the CBE’s interest rate corridor. At the same time, the CBE will remain committed to preserving financial stability and will continue to strengthen the transparency and communication of its instructions and analysis in this area.” the government added.