Turkey’s GDP growth is expected to decelerate from 4.5 per cent in 2023 to 3.4 per cent in 2024 and 3.2 per cent in 2025, according to the Organisation for Economic Co-operation and Development’s (OECD) updated Economic Outlook.

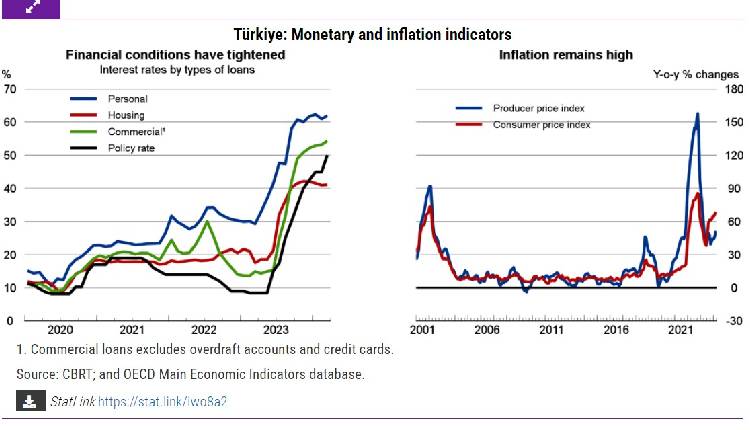

The slowdown is attributed to tighter financial conditions and the impact of high inflation on purchasing power.

“Tighter financial conditions and the adverse impact of inflation on purchasing power will subdue household consumption. Investment activity is expected to remain strong partly due to the ongoing reconstruction following the 2023 earthquake. Exports will gradually strengthen reflecting an improved external environment. Inflation peaked at the beginning of this year but will remain elevated over 2024 and 2025.” OECD report explained.

However, the latest forecast marks an upward revision from OECD’s earlier estimates made in February, when it said the Turkish economy would grow by 2.9 per cent in 2024 and 3.1 per cent in 2025.

Despite these challenges, investment activity is projected to remain robust, partly fueled by the ongoing reconstruction efforts following the 2023 earthquake. However, inflation, which peaked at the start of the year, is predicted to remain high over the next two years increasing from 53.9 per cent in 2023 to 55.5 per cent in 2024,

The Central Bank has been tightening monetary policy to restore price stability, raising the policy interest rate from 8.5 per cent in June 2023 to its current level of 50 per cent.

The government has also announced fiscal tightening measures, including a triple tax on gasoline and increased VAT rates, as part of a broader effort to put Turkey’s economy back on a sustainable path.

Despite robust private consumption and a record influx of 50 million tourists in 2023, the economy faces challenges. The unemployment rate is expected to rise to 10 per cent by mid-2025, and inflation remains a significant risk. However, credible improvements in fiscal, financial, and monetary policy could attract more foreign investment and boost growth.

The economy also needs to become more resilient to climate change and energy shocks through adaptation policies, a greening of the energy mix, and improvements in energy efficiency. Wider structural reforms, including labour-market reforms, are needed to support macroeconomic stabilisation and raise long-term potential growth.