US refining capacity saw a notable increase in 2023, driven by expansions at existing facilities, according to the latest Refinery Capacity Report by the US Energy Information Administration (EIA).

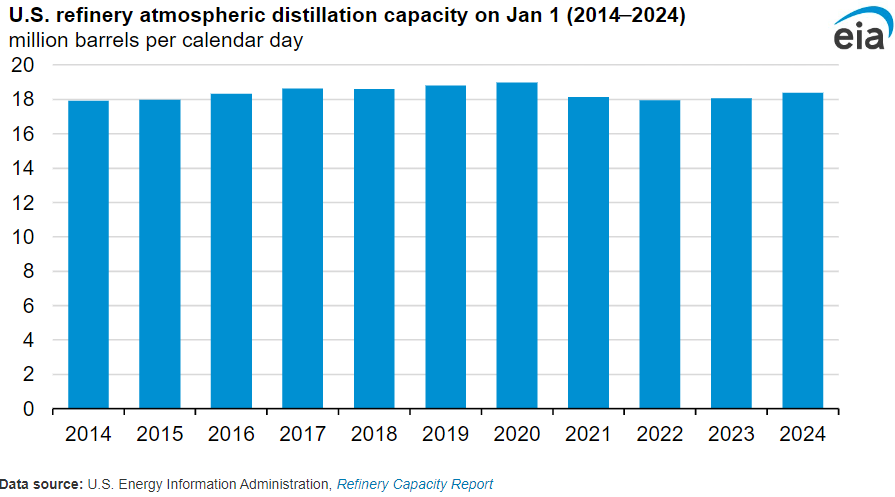

As of January 1, 2024, the nation’s operable atmospheric crude oil distillation capacity stood at 18.4 million barrels per calendar day (b/cd), reflecting a 2 per cent rise from the previous year.

The capacity expansion primarily stemmed from upgrades at major refineries. ExxonMobil’s Beaumont, Texas facility increased its capacity from 369,000 b/cd to 609,000 b/cd. Valero’s Port Arthur refinery added 25,000 b/cd, bringing its total to 360,000 b/cd, while Marathon’s Galveston Bay refinery saw a 6 per cent increase, reaching 631,000 b/cd. As a result, Marathon’s facility surpassed Motiva’s Port Arthur refinery to become the largest in the US by atmospheric distillation capacity.

Key transactions in 2023 included Cenovus’s acquisition of BP-Husky’s Toledo refinery, ExxonMobil’s sale of its Billings refinery to Par Montana, and Oneok’s purchase of Magellan Midstream Partners, including its Corpus Christi splitter.

The report also noted a reduction in refining capacity due to Phillips 66’s transition of its Rodeo refinery to biofuels production, and a potential delay in LyondellBasell’s planned closure of its Houston refinery.

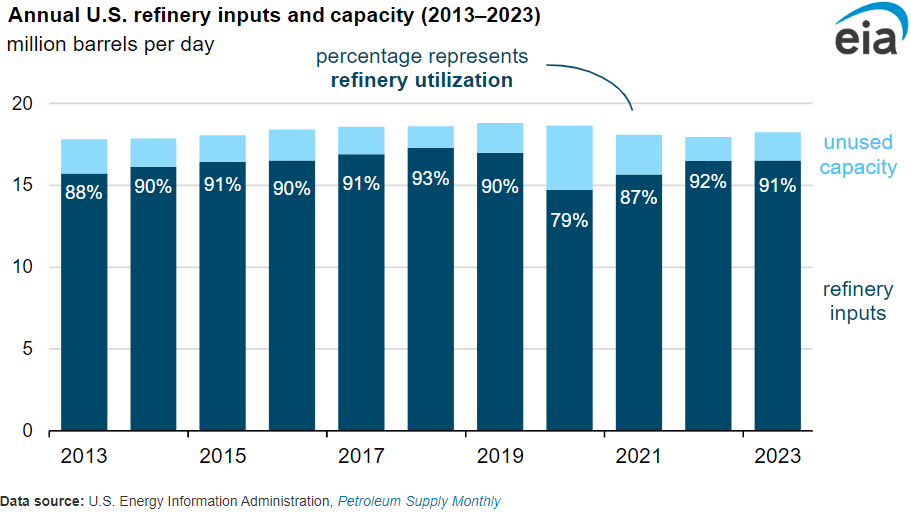

Overall, refinery utilisation decreased to 91 per cent in 2023, as capacity additions outpaced input increases. Secondary unit capacities, including thermal cracking and catalytic cracking, also saw modest gains.

Attribution: EIA