Oil companies in Iraq’s Kurdistan region are planning expansions, despite the increasing pressure from Baghdad to reduce the country’s output in compliance with OPEC+ quotas.

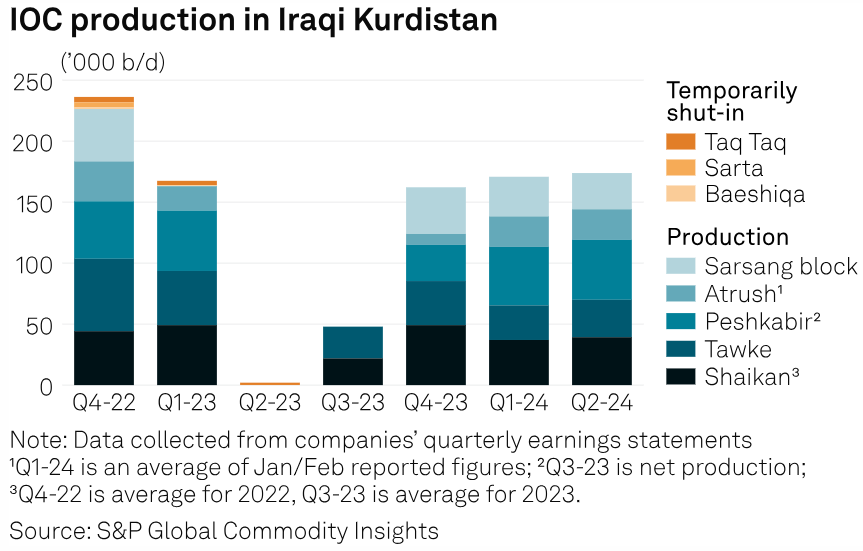

According to financial filings from five public oil companies, the crude production in the Kurdistan region has steadily risen, reaching 173,000 barrels per day (b/d) in the second quarter of 2024. This marks a significant increase from the previous quarter’s 170,000 b/d and stands in stark contrast to the mere 2,000 b/d produced in the quarter following the closure of the region’s key export pipeline to Turkey in March 2023.

Including the Kar Group’s production, total output is estimated to be around 250,000 b/d, a decline from the approximately 400,000 b/d produced before the pipeline closure.

Several international oil companies are expanding their operations in the Kurdistan region. Norwegian company DNO plans to drill a new well on its Tawke licence, while Canada’s Shamaran Petroleum expects increased output from its Atrush and Sarsang blocks. Gulf Keystone has also resumed profitability after implementing 24-hour trucking operations due to rising production and demand.

Baghdad’s compliance with OPEC+ quotas is being challenged by the growing Kurdish production. Iraq’s July output exceeded its quota, prompting demands for the Kurdistan Regional Government (KRG) to reduce its production and compensate for the excess.

While SOMO estimates Kurdish production at 150,000 b/d, Baghdad has threatened to withhold the KRG’s federal budget share. The KRG and the Association of the Petroleum Industry of Kurdistan have yet to respond.

It’s worth noting that local crude prices remain significantly lower than global benchmarks, ranging from $28 to $40 per barrel. Additionally, the region’s refining capacity remains substantial, further complicating the situation. The ongoing pipeline closure continues to have a significant impact on the region’s oil industry.

Attribution: S&P Global Commodities Insights

Subediting: Y.Yasser