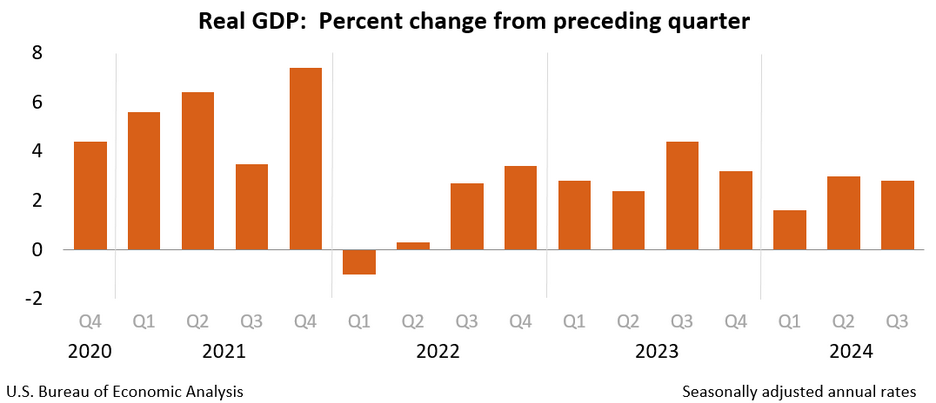

The US real gross domestic product (GDP) expanded at an annual rate of 2.8 percent in the third quarter of 2024, according to a second estimate by the Bureau of Economic Analysis (BEA) on Wednesday. This marks a slight deceleration from the 3.0 percent growth rate recorded in the second quarter of the year.

The revised estimate is based on more comprehensive data compared to the initial “advance” estimate, which also reported a 2.8 percent growth rate.

Key Drivers of Economic Growth

The third-quarter GDP increase was primarily driven by robust consumer spending, exports, federal government spending, and nonresidential fixed investment. These sectors saw significant growth, reflecting strong demand and investment in the economy. In contrast, imports, which are subtracted when calculating GDP, grew during the third quarter, further contributing to the overall expansion.

Comparing to the Second Quarter

The third-quarter slowdown compared to the second quarter was primarily due to a sharp decline in private inventory investment, as well as a larger-than-expected drop in residential fixed investment. These negative factors were somewhat offset by stronger growth in exports, consumer spending, and federal government expenditures. Notably, imports accelerated during the quarter, which also impacted the GDP calculation.

“Compared to the second quarter, the deceleration in real GDP in the third quarter primarily reflected a downturn in private inventory investment and a larger decrease in residential fixed investment. These movements were partly offset by accelerations in exports, consumer spending, and federal government spending. Imports accelerated.”

Current-Dollar GDP

In current dollars, the GDP for the third quarter increased by 4.7 percent, or $337.6 billion, reaching a total of $29.35 trillion. This represented an upward revision of $4.4 billion from the previous estimate.

PCE

The price index for gross domestic purchases, a key measure of inflation, rose by 1.9 percent in the third quarter, reflecting a modest upward revision of 0.1 percentage point from earlier estimates. The personal consumption expenditures (PCE) price index, which tracks inflation in consumer goods and services, rose 1.5 percent—unchanged from the previous estimate. However, excluding volatile food and energy prices, the PCE price index increased 2.1 percent, which was a downward revision of 0.1 percentage point.

Personal Income and Saving

Current-dollar personal income saw a notable increase of $175.9 billion in the third quarter, although this was a downward revision of $45.3 billion from the earlier estimate. The majority of this growth came from increases in compensation. Disposable personal income, which accounts for income after taxes, grew by $122.9 billion, a 2.3 percent increase. However, this was also revised downward by $43.1 billion compared to the initial estimate.

The rate of personal saving during the quarter stood at $934.4 billion, a downward revision of $34.0 billion. The personal saving rate, which is the percentage of disposable personal income saved by individuals, was 4.3 percent, reflecting a revision of 0.5 percentage point downward from the previous estimate.

Gross Domestic Income (GDI) and Corporate Profits

Real gross domestic income (GDI), which measures the total income generated by the production of goods and services, increased by 2.2 percent in the third quarter, slightly higher than the 2.0 percent growth in the second quarter. The average of real GDP and real GDI, a supplemental measure of economic activity, increased by 2.5 percent, the same as the second quarter.

However, corporate profits with inventory valuation and capital consumption adjustments declined by $10.2 billion in the third quarter, a stark contrast to the $132.5 billion increase recorded in the second quarter. Profits of domestic nonfinancial corporations grew by $30.8 billion, but this was a sharp slowdown from the $108.8 billion increase in the previous quarter. Profits from the rest of the world decreased by $38.3 billion, reflecting a decrease in both receipts (of $52.5 billion) and payments from foreign transactions (of $14.2 billion).

Revisions to Economic Data

The second estimate for third-quarter GDP includes several important revisions. Private inventory investment, nonresidential fixed investment, and state and local government spending were revised upward, while exports, consumer spending, and federal government spending were revised downward. Imports, which are subtracted from GDP, were also revised downwards.

Attribution: Bureau of Economic Analysis (BEA)