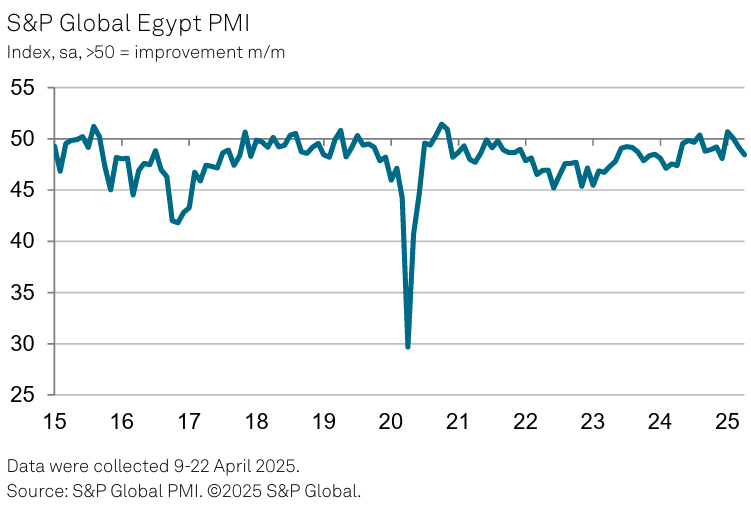

Egypt’s non-oil private sector saw its sharpest decline in four months in April, as the S&P Global Purchasing Managers’ Index (PMI) fell to 48.5, down from 49.2 in March. The reading signalled a deepening contraction driven by lower output, new orders, and employment amid a challenging demand environment.

The April survey highlighted a sustained drop in new business, prompting firms to scale back output for the second consecutive month. The rate of decline in both output and new orders accelerated to the quickest since December 2024, with respondents citing weak demand in both domestic and international markets. In turn, firms reduced purchasing activity and trimmed their workforce for the third month running.

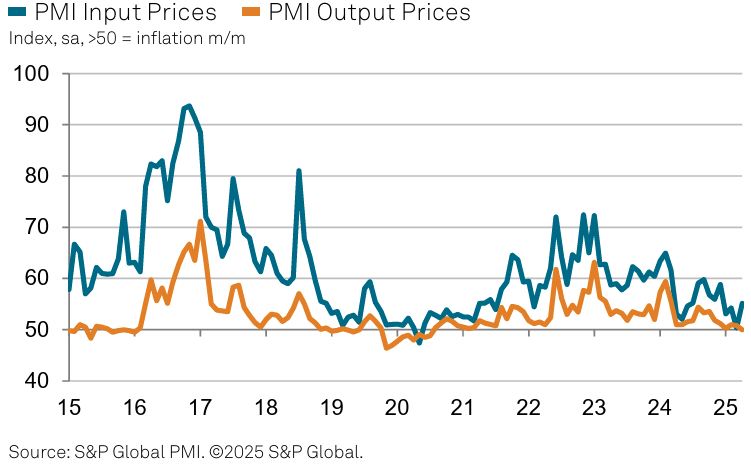

Despite a surge in input costs—largely linked to a reported 15 per cent increase in fuel prices—businesses kept selling prices unchanged, bringing an end to a 56-month streak of output price inflation. The stabilisation of prices was attributed to subdued sales and easing pressure on input costs in earlier months. While cost burdens rose due to higher energy, material, and staffing expenses, the output price index fell to the neutral 50.0 mark in April.

The downturn in purchasing activity was the sharpest since October 2024, although moderate overall. Supplier delivery times remained unchanged for the month, following two months of improvement, as weaker demand limited strain on supply chains.

Firms were able to marginally increase inventories and reduce backlogs of work, further reflecting the muted operating environment. Nonetheless, business confidence improved slightly, reaching a three-month high, as some companies expressed hopes of a recovery in market conditions both domestically and abroad.

Attribution: Amwal Al Ghad English

Subediting: M. S. Salama