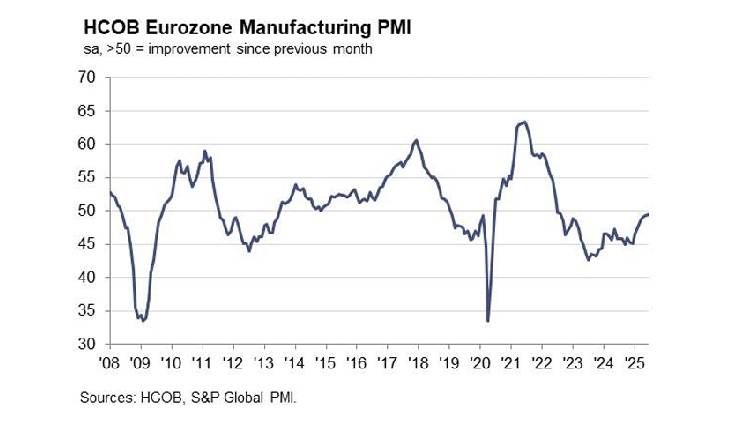

The Eurozone’s private sector showed sideways movement in June, with the HCOB Flash Composite PMI Output Index unchanged at 50.2, indicating continued stagnation.

The latest data, compiled by S&P Global, reflect subdued business conditions as the region grapples with weak demand and uneven sector performance.

Manufacturing output rose for a fourth consecutive month but at a slower pace, with the Output Index slipping to 51.0 from May’s 51.5. Services activity stabilised after a May contraction, with the Business Activity Index rising to 50.0 — a two-month high.

Germany posted marginal growth, while France remained in contraction for a tenth month. The rest of the euro area saw activity expand, but at the slowest pace since November. New orders neared stabilisation, with manufacturing bookings flat for the first time in over three years. Export demand fell only slightly, and Germany recorded its first increase in foreign orders in nearly three-and-a-half years.

Employment edged up, led by services, though manufacturing jobs declined further. Input cost inflation eased to its weakest since November 2024. Services continued to face strong cost pressures and raised prices at the fastest pace in three months, while manufacturers cut output prices for a second month.

Supplier delivery times lengthened for the first time in five months, reflecting renewed geopolitical risks and shifting trade conditions. Business confidence improved to its highest level since January, with optimism rising sharply in France and holding firm across the region.

Commenting on the data, HCOB Chief Economist Cyrus de la Rubia noted the economy is struggling to gain momentum, but improving sentiment and steady employment suggest underlying resilience. He added that recent energy price increases linked to Middle East tensions are yet to fully impact inflation but the ECB can remain relatively calm given broader disinflationary pressures.

Attribution: Amwal Al Ghad English

Subediting: M. S. Salama