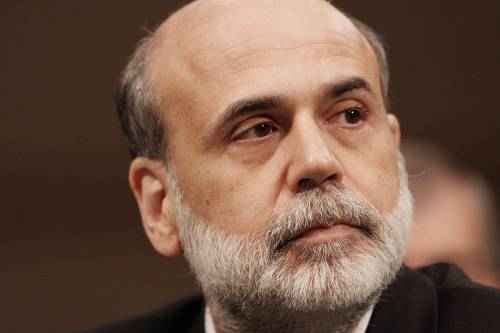

Federal Reserve Chairman Ben S. Bernanke said a process under development that would allow regulators to take down a failing bank will help ensure investors discipline weak firms and prevent them from taking risks without consequence.

“As we try to make the financial system safer, we must inevitably confront the problem of moral hazard,” Bernanke said today in remarks at an International Monetary Fund conference in Washington. “Market discipline can only limit moral hazard to the extent that debt and equity holders believe that, in the event of distress, they will bear costs.”

He addressed the economy only briefly during the panel discussion, saying that there was still “an awful lot of slack in the labor market” and said that was justification for the Fed taking “strong actions to try to support job creation.”

In response to audience questions, Bernanke said that the high level of student debt is “another drag on the recovery” although it is not likely to cause a financial crisis because most such loans are owned by the government, not financial institutions.

Financial Crises

Bernanke spoke as part of a panel discussion that included Harvard University’s Kenneth Rogoff, the co-author of the history of financial crises titled “This Time Is Different: Eight Centuries of Financial Folly”; former Bank of Israel governor Stanley Fischer; and former U.S. Treasury Secretary Larry Summers.

Summers was under consideration by President Barack Obama to become Bernanke’s successor, when his term expires in January. He withdrew from the process in September, saying the confirmation would have been “acrimonious.”

The forum today gave Summers an opportunity to discuss monetary policy in front of the man he would have replaced.

“We’ve done a lot of QE, and the inflation rate in the United States is not conspicuously higher than it was before we started,” Summers said, as he questioned whether the Fed had the power to resolve the economy’s weakness on its own.

Bernanke has said monetary policy is “not a panacea” and has cautioned that fiscal policy is restraining the economy.

In his prepared remarks, Bernanke said regulators have been working to devise so-called orderly liquidation authority that would allow a systemically important financial institution, or SIFI, to be closed down without the chaos that surrounded the failure of Lehman Brothers Holdings Inc. and the bailout of American International Group Inc. in September 2008.

‘Terrible Choices’

“In the crisis, the absence of an adequate resolution process for dealing with a failing SIFI left policy makers with only the terrible choices of a bailout or allowing a potentially destabilizing collapse,” Bernanke said. “A credible resolution mechanism for systemically important firms will be important for reducing uncertainty, enhancing market discipline, and reducing moral hazard.”

Bernanke led the central bank through a financial crisis and 18-month recession that was the longest and deepest since the Great Depression. The Standard & Poor’s 500 Index reached a 12-year low in March 2009. Joblessness peaked at a quarter-century high of 10 percent in October 2009. By March 2010, 10.1 percent of all mortgage loans were delinquent, according to data from the Mortgage Bankers Association.

The 59-year-old Fed chief devoted most of his prepared remarks to comparing what happened five years ago to “a classic financial panic” like the banking panic in 1907 that led to the creation of the U.S. central bank 100 years ago.

Source: Bloomberg