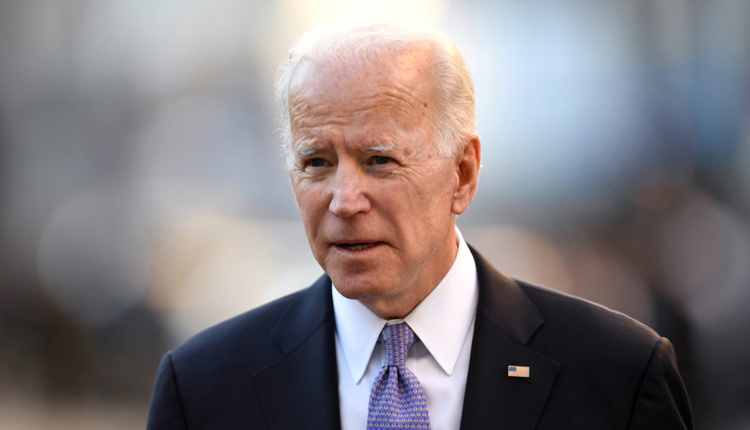

U.S. President, Joe Biden has urged federal regulators to take more drastic measures and called for tighter regulations in order to prevent another collapse of mid-sized banks like Signature Bank, the White House announced on Thursday.

Biden’s call comes in light of his recent efforts to have more strict oversight and regulations of banks, to prevent another collapse from happening, as they would be a shield to banks with assets between $100 billion and $250 billion.

The proposals include raising liquidity requirements for mid-sized banks, updating and increasing the frequency of liquidity stress tests to check high speed digital withdrawals and requiring banks to submit plans on why they would close in case they collapse.

The proposals also include updating stress tests to account for recent situations that are not in current models and limiting which banks must contribute to replenishing the Deposit Insurance Fund.

“Each of these items can be accomplished under existing law,” said the White House. Some of the proposals by the Biden administration are under consideration, bank regulators testifying before two congressional committees stated this week.

Members of the Republican Party are more skeptical of regulations than the Democratic Party, saying that federal officials had the necessary tools to prevent the recent bank collapses, but did not use them properly.

“As we heard from Biden’s own regulators at our hearing yesterday, supervisory incompetence was the leading cause of the failures, instead of giving more authority to regulators who were asleep at the wheel before these bank failures, we should hold them accountable for their inability to utilize their existing supervisory tools,” said Rep. Patrick McHenry, chair of the House Financial Services Committee.

Meanwhile, a group of Democratic senators, led by financial regulator, Sen. Elizabeth Warren, sent a letter to bank regulators, calling for firmer bank capital requirements.

Warren, alongside Sen. Catherine Cortez Masto, introduced legislation Wednesday, requiring federal regulators to regain all or part of compensation earned by executives in the five years prior to a bank failure.

While the Biden administration is calling for banking sector regulations, the Trump administration passed a deregulation bill in 2018, which limited regulator’s ability to impose liquidity demands and stress tests on small banks.