Global financial services firm BNY Mellon has raised concerns about the surge in foreign investment into Turkish assets, suggesting that the current enthusiasm may be overlooking significant risks.

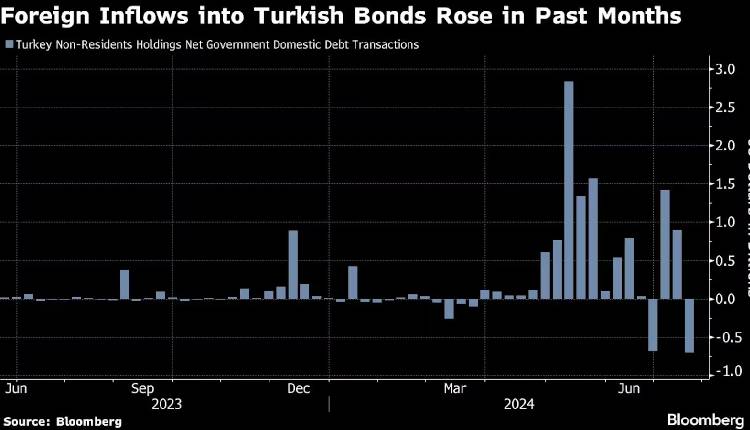

Investors have funnelled billions of dollars into Turkish assets this year, driven by hopes of currency appreciation amid high interest rates. However, Bob Savage, BNY Mellon’s head of markets and strategy, warned of potential pitfalls that could lead to a reversal in fortunes.

Savage pointed to geopolitical tensions, including escalating conflicts involving Iran and Israel, as well as the ongoing Russia-Ukraine conflict, which could adversely affect Turkey.

Despite these concerns, global investors have been attracted by Turkey’s high interest rates, with the central bank maintaining a 50 per cent benchmark rate for a fourth consecutive month. This decision followed Moody’s recent upgrade of Turkey’s credit rating by two notches, the first increase in 11 years.

Savage cautioned that the sustainability of such high interest rates is uncertain and noted that current investor positioning—long on bonds, equities, and the currency—could face a reversal.

Bank of America strategists estimate that Turkish lira forwards might exceed $20 billion, while Deutsche Bank and Pictet Asset Management have been bullish on Turkish debt and currency.

Savage suggested that a shift could occur in the fourth quarter or early next year, with capital potentially moving to other frontier economies like Egypt, Nigeria, and Argentina.

He emphasised that while Turkey’s policies are seen as positive, the current level of investment might not be fully justified given the underlying risks.

Attribution: Bloomberg.