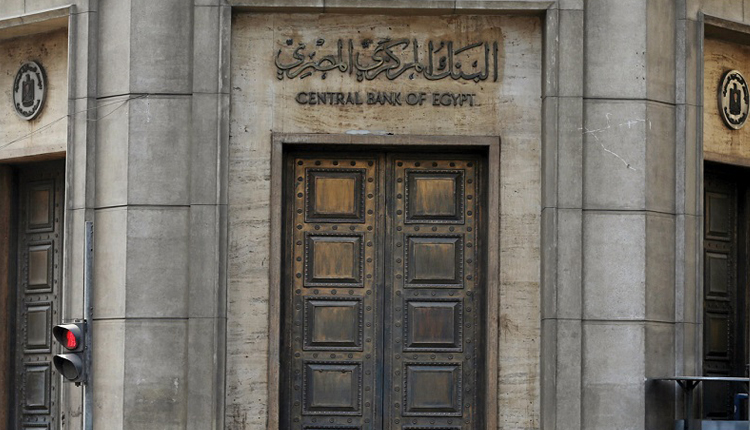

CBE Egypt likely to keep interest rates steady despite Turkish lira crisis

The Central Bank of Egypt’s monetary policy committee is expected to keep interest rates unchanged when it meets on Thursday despite concerns about inflation and the plunge in the lira of Turkey, analysts say.

The predictions come despite the cooling of the headline inflation rate in July to 13.5 percent, after surging to 14.4 percent in June.

“We expect the Central Bank of Egypt to opt for stable rates awaiting signs that the headline monthly inflation numbers have stabilised,” Mohamed Abu Basha, head of macroeconomic analysis at EFG Hermes, told Reuters on Tuesday.

The decision from the committee will come as central banks in a number of emerging market countries look to prevent potential contagion from the Turkish economic crisis.

The Turkish lira suffered its worst one-day loss in a decade last week, after President Donald Trump announced on Friday that tariffs on Turkish steel and aluminium would be doubled; the lira lost about 20 percent of its value against the US dollar.

The Egyptian monetary policy committee has kept rates the same at its last two meetings, maintaining the overnight deposit rate, overnight lending rate, and the rate of the main operation at 16.75 percent, 17.75 percent, and 17.25 percent, respectively.

The discount rate was also kept unchanged at the last two meetings, at 17.25 percent.

The last cuts were in March, and before that in February, when rates were slashed by 100 basis points each time.

The effect of the lira’s devaluation on Egypt is of great importance, especially after the cancellation of contracts for Egyptian readymade clothes by Turkish importers, according to the Textiles Industry Council’s deputy head Magdy Tolba, who spoke to Amwal Al-Ghad.

Tolba added that Egyptian textile exports to Turkey make up 30 percent of all of Egypt’s textile exports.

Moreover, Sherif El-Diwany, former director of the Middle East and North Africa at the World Economic Forum, said during a recent forum event in Geneva that the Turkish market has an advantage in the exportation markets where both Egypt and Turkey export the same products, explaining that “Egypt cannot well compete with Turkey in exporting textiles to the same markets, as the lira is now down, hence prices will be lower than before.”

Economic development expert Sherif Delaware, however, told Ahram Online that the effect of the Turkish economic crisis is unpredictable due to the complexity of the situation and its dense economic and political aspects. He added that even if Egyptian exports are negatively affected by the crisis, Egyptian imports from Turkey should be cheaper, and the net effect may therefore be neutral.

Mohamed Abu Basha, was also optimistic despite the crisis in Turkey, telling media outlets that the total Turkish market share of Egyptian exports is about five percent, which is a very modest share that supposedly should not have a significant impact on the Egyptian market.

In addition, Finance Minister Mohamed Maait told Egyptian news service Enterprise on Monday that not only is Egypt not vulnerable, but that the Turkish crisis has in fact driven further portfolio inflows to Egypt in the last week.

Source: Ahram Online