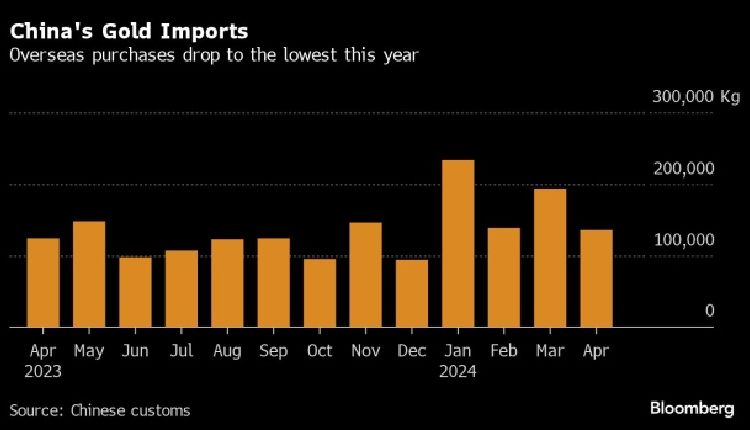

China’s demand for gold is decreasing as high prices impact consumption, with April’s physical gold imports slumping 30 per cent to a 2024 low of 136 tons, Bloomberg reported on Tuesday, citing recent customs data.

US interest rates impact gold prices, but China’s strong consumption has recently driven prices up.

Limited investment options in China have increased demand for gold as households and investors seek safety amid challenges in the property sector, stock markets, and currency devaluation. This trend has led to record-high gold prices.

China’s central bank has been consistently buying gold to diversify reserves and hedge against currency depreciation, although the pace of purchases slowed in April, the report added.

Analysts expect strong demand from China in 2024, but the high import volume seen in the last quarter may stabilise. Soni Kumari, a commodity strategist at ANZ Group Holdings Ltd., noted that Chinese authorities have cautioned against excessive gold speculation.

The Shanghai Gold Exchange increased margin requirements on specific contracts starting Tuesday, aiming to reduce risk-taking.

Since the Paris Agreement was signed eight years ago, planned new coal capacity globally has decreased by almost 70 per cent. However, China and India, two of the top three emitters, are not following this positive trend.

During Putin’s visit to China, he and Xi Jinping emphasised their strong friendship, but a 2,000-mile pipeline project between the two countries is currently stalled, suggesting China’s lack of full commitment to the gas pipeline.