Danske Bank upgraded on Wednesday its growth forecast for China, citing the positive impact of recent stimulus measures and anticipated fiscal actions. The bank now expects China’s GDP to grow by 5.2 per cent in 2025, up from its previous forecast of 4.8 per cent.

For 2024, Danske Bank keeps its forecast at 4.8 per cent, saying that without the stimulus it would have lowered it following the recent weak data, but now the bank decided to keep it unchanged.

“The stimulus is the strongest coordinated push to lift the economy since the global financial crisis in 2008. We expect China to follow up with fiscal stimulus measures on the other side of the National Day holiday.” Danske Bank said in a research note.

A key assumption is that China will continue to implement stimulus measures until there are clear signs of recovery in the housing market and consumer confidence. If stimulus is withdrawn too early, there is a risk of a renewed economic slowdown.

While the specific growth rate is important, it is also crucial to consider the drivers of the recovery. Danske Bank expects stimulus measures to be the primary driver in the first half of 2025, while organic growth from housing, household consumption, and state-led investments will become more significant in the second half.

“In the first half, we expect the stimulus to be the main engine but in the second half, we look for more ‘organic’ growth coming from a gradual lift to housing and household consumption from state led investments.”

“If China succeeds in turning the negative confidence around, they will be able to withdraw stimulus and the growth will be able to stand on its’ own feet with real domestic demand being a stronger force during 2025.”

Danske Bank believes that it will take time for consumer confidence to recover and for households to increase spending. Policymakers are also cautious about stimulating the housing market too aggressively, as this could be counterproductive to long-term economic goals.

The extent of China’s recent stimulus package surprised many, including Danske Bank. While China has implemented stimulus measures in the past, this latest package is significantly larger. Danske Bank believes that Chinese leaders decided to take more decisive action now to avoid a prolonged economic downturn and social instability.

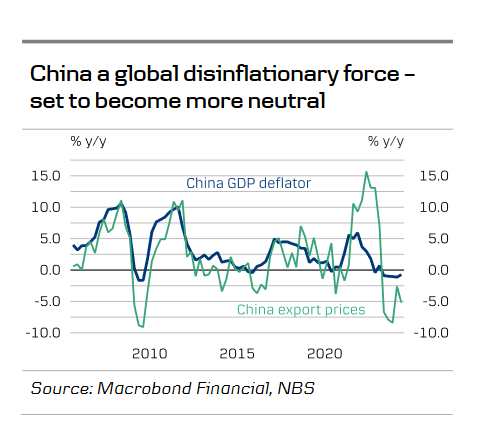

Looking ahead, Danske Bank expects China to gradually become less of a disinflationary force and more of a neutral force for global inflation. While housing demand and domestic consumption are expected to increase, Danske Bank does not anticipate a rapid rebound in growth or a significant inflationary impact in the next 6-12 months.

Attribution: Danske Bank