The Egyptian Exchange (EGX) has turned its opening losses into gains of EGP 728 million during Monday’s closing session. The capital market has amounted to EGP 369.899 billion.

The main index, EGX30 inched up by 0.20% to end at 5372.66 p. EGX20 rose by 0.09% to close at 6199.45 p.

Meanwhile, the mid- and small-cap index, the EGX70 went up by 0.30% to conclude at 476.09 pts. Price index EGX100 increased by 0.30% to finish at 795.18 p.

Traded volume reached 102.777 million securities worth EGP 323.023 million, exchanged 20.615 thousand transactions.

This was after trading in 175 listed securities; 87 declined, 61 advanced; while 27 keeping their previous levels.

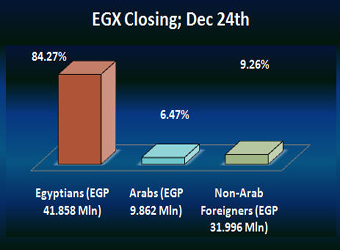

The EGX’s closing gains were backed by the non-Arab foreigners and Arabs’ buying transactions as they were net buyers seizing 9.26% and 6.47% respectively, of the total markets, with a net equity of EGP 31.996 million and EGP 9.862 million excluding the deals.

On other hand, Egyptians were net sellers seizing 84.27% of the total markets, with a net equity of EGP 41.858 million excluding the deals.

Egypt’s Islamist-backed constitution headed toward likely approval in a final round of voting on Saturday, but the deep divisions it has opened up threaten to fuel continued turmoil.

Passage is a victory for Islamist President Mohammed Morsi, but a costly one. The bruising battle over the past month stripped away hope that the long-awaited constitution would bring a national consensus on the path Egypt will take after shedding its autocratic ruler Hosni Mubarak nearly two years ago.

Meanwhile, in a sign of disarray in Morsi’s administration, his deputy and – possibly – the Central Bank governor resigned during the latest voting. Vice President Mahmoud Mekki’s resignation had been expected since his post is eliminated under the new constitution. But its hasty submission even before the charter has been sealed and his own resignation statement suggested it was linked to Morsi’s policies.