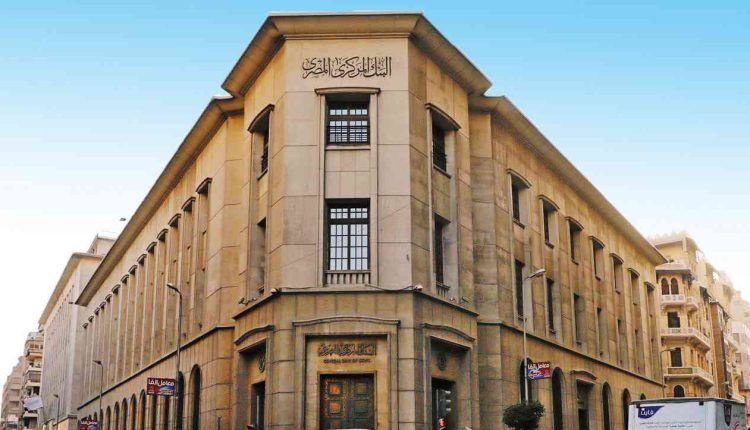

Egypt’s Balance of Payments (BoP) has unfolded an overall surplus in the first quarter of 2023/2024 fiscal year amounting to $228.8 million against $523.5 million during the same period a year earlier, a recent central bank data showed.

The Central Bank of Egypt (CBE) clarified that the current account deficit improved by 12.1 per cent, reaching $2.8 billion, compared to $3.2 billion, driven mainly by the decline in the trade deficit by 12.7 per cent to record $7.9 billion.

The decline was also due to the rise in services surplus to $5.2 billion, buoyed by the increase in both the Suez Canal transit receipts and tourism revenues, the statement mentioned.

The capital and financial account also saw a net inflow of $1.8 billion, with foreign direct investment (FDI) in Egypt amounting to a net inflow of $2.3 billion, while portfolio investments in Egypt continued to achieve a net outflow of $523.4 million.

Factors that contributed to retreat the current account deficit:

- Non-oil trade deficit improved by $2.4 billion, reaching $6.6 billion, compared to $9.0 billion, mainly reflecting the decline in non-oil merchandise imports by $1.9 billion.

- Non-oil merchandise imports fell by 12.5 per cent, to $13.3 billion, compared to $15.3 billion.

- Non-oil merchandise exports surged by $458.9 million, to $6.7 billion, compared to $6.3 billion.

- Transport receipts increased by 13.5 per cent, reaching $3.5 billion, compared to $3.0 billion.

- The Suez Canal transit receipts increased by 19.4 per cent to $2.4 billion, compared to $2.0 billion.

Factors that reined the improvement of the current account deficit:

- The deficit of oil trade balance widened by $1.2 billion to $1.3 billion, compared to $106.0 million, driven by the decline in oil exports.

- Egyptian workers’ remittances declined by 29.9 per cent to record $4.5 billion, down from $6.4 billion.

- Investment income deficit slightly increased by 1.1 per cent to $4.6 billion, up from $4.5 billion, as investment income payments went up by $187.2 million to $5.0 billion, compared to $4.8 billion.