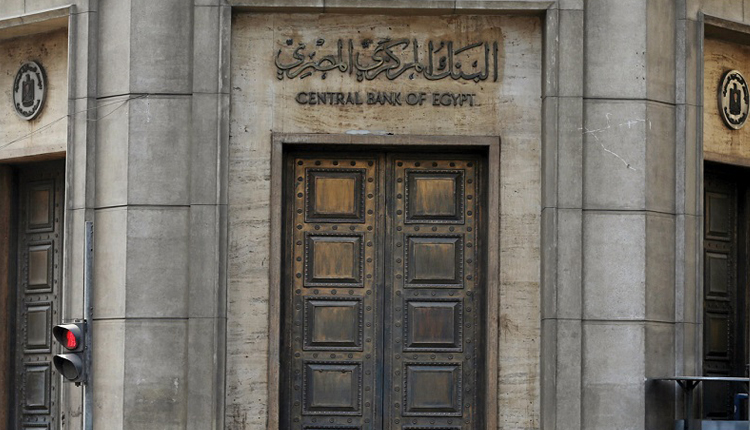

Central Bank of Egypt (CBE) managed to attract more than 21 billion Egyptian pounds ($1.3 billion) in investments from treasury bills (T-bills).

The bank offered 266-day T-bills and 91-day T-bills in an auction on Sunday with the aim of attracting 19 billion pounds, with interest rates ranging between 12.9 percent and 13.6 percent.

There were 278 bids made for the 266-day term T-bills, while 222 bids were submitted for the 91-day T-bills, with total investments reaching over 43 billion pounds.

The CBE has accepted 207 bids for the 266-day T-bills, with total investments of about 15.6 billion pounds, and 140 bids for the 91-day T-bills, with total investments of about 5.9 billion pounds, bringing the total to more than 21 billion pounds.

T-bill auctions are an instrument that the government uses to finance the public budget to bridge the budget deficit.

In August, the CBE announced that Egypt’s net international reserves (NIR) grew slightly to reach $38.36 billion by the end of August, up from $38.31 billion recorded in July, which is the third time the NIR saw an increase since the significant drop it had witnessed in March, where it recorded $40 billion, down from $45.4 billion, on the back of the COVID-19 pandemic.