Egypt’s c.bank expects 200bps interest rate hikes next Thursday- Reuters poll

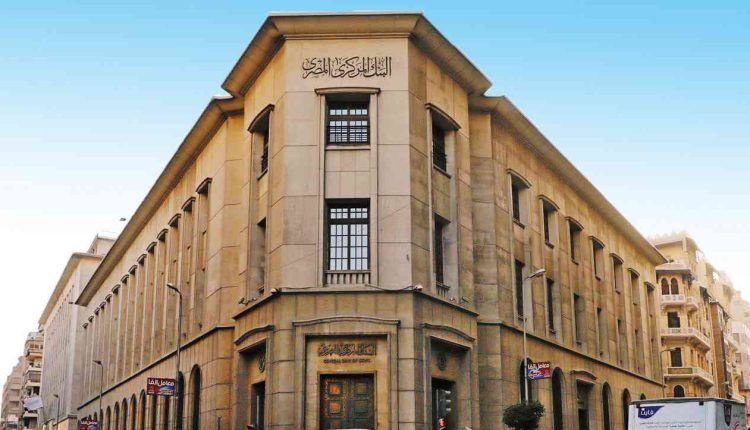

The Central Bank of Egypt (CBE) will raise its overnight interest rates by 200 basis points on Thursday, a Reuters poll predicted on Tuesday. This step will come as a try for CBE to quell soaring inflation after a sharp devaluation of the currency.

CBE may raise its deposit rate to 15.25 percent and its lending rate to 16.25 percent at its regular monetary policy committee meeting, according to 12 analysts’ expectations.

On the other hand, Mohamed Abu Basha of EFG-Hermes expects smaller rate hike “we project CBE to hike rates by 100 bps in an effort to signal continued monetary tightening amidst rising inflation expectations.”

For his side, Jacques Verreynne of Oxford Economics said, “with inflation having risen more than expected, we now expect the CBE to raise policy rates by a further 100 bps.”

In October, CBE has raised rates by 200 basis points at a surprise meeting as it allowed the currency to weaken by 14.5 percent.

Moreover, the bank had reached a staff-level agreement on a $3 billion financial support package with the International Monetary Fund (IMF).

Noteworthy, that the gap between the official and black-market rates against the dollar has continued to widen, with one dollar fetching about 24.70 pounds at banks while 33 pounds on the black market.

The Central Bank of Egypt said after its last meeting that prices would continue to exceed its inflation target range of 5-9 percent during the fourth quarter.