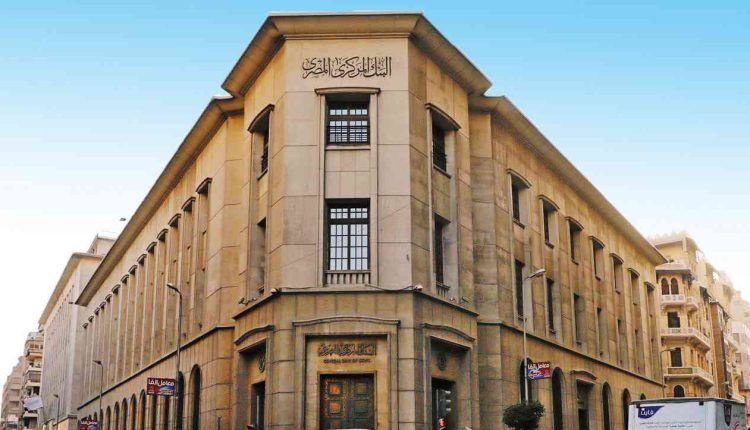

Egypt’s central bank (CBE) on Sunday issued an overview of their auctioning procedures.

According to the clarifications published on CBE website, the Central Bank of Egypt conducts auctions for both Open Market Operations (OMO) and government securities, offering banks and investors opportunities to participate in managing liquidity and financing the government.

The CBE conducts two types of deposit auctions to absorb excess liquidity from banks:

Weekly fixed-rate main operation: This auction occurs every Monday, with bids accepted at the key policy rate.

Variable rate corridor-linked deposit: Amounts and durations for these auctions are announced on Tuesdays, with the bids taking place the next day.

Allocation is done through the form of an American Type Auction among bidders at a spread above the mid-corridor.

Bidding process for deposits

- Bidding opens at 8:00 AM and closes at 11:00 am on auction days.

- Participating banks can submit up to three bids, specifying desired amounts and interest rates.

- Auction results are available on the CBE website, its auction system portal, and financial information services like Refinitiv and Bloomberg.

Selling government securities

The CBE acts as an agent for the Ministry of Finance, auctioning government securities like treasury bills (T-Bills) and bonds (T-Bonds) according to a quarterly issuance calendar.

Bidding process for government securities

- Auction details, including amounts, durations, and key dates, are published in advance on the CBE website, auction system, and financial information services.

- Bidding occurs electronically through the CBE’s Primary Auction System, closing at 11:00 am on auction days.

- Non-primary dealers can participate by submitting bids through approved primary dealers.

- Individual investors can participate by contacting their banks to submit bids.

- Bids are to be in multiples of EGP 25,000 of face value for T-Bills and EGP 1,000 for T-Bonds.

Allocation and Settlement

Winning bids are determined using an American auction format, with successful bids at the highest accepted rates allocated proportionally to the total auction amount.

Settlement of purchased securities occurs simultaneously with cash settlement through the RTGS system, following a Delivery vs. Payment (DVP) model.