Egypt’s inflation has jumped to 36.8 percent, and as a result, Egyptian policymakers are likely to keep adopting the fiscal tightening polices with an interest rate hike, Capital Economics said on Monday.

The annual urban Consumer Price Inflation (CPI) jumped to 35.7 percent, from 32.7 percent in May, while the annual inflation increased from 14.5 percent, triggered by an increase in food and beverages by 64.9 percent, said Egypt’s Central Agency for Public Mobilization and Statistics.

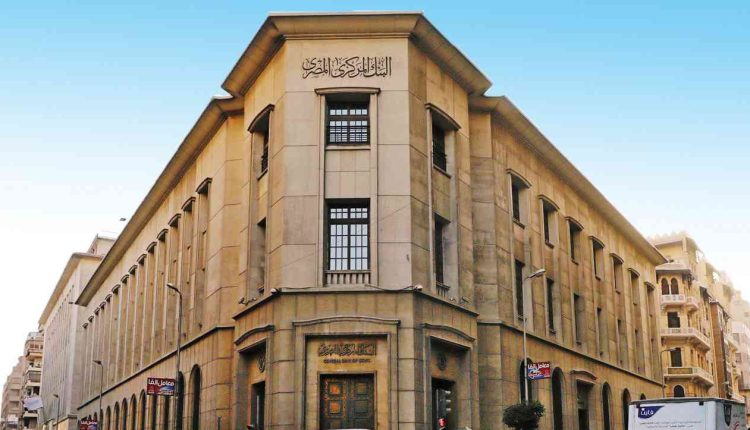

“We expect that the Central Bank of Egypt will resume its tightening cycle in the comping months and hike interest rates by a further 200bp, taking the overnight deposit rate to 20.25 percent,” said Capital Economics.

The Central Bank of Egypt (CBE) had previously decided to leave interest rates unchanged at 18.25 percent.

“The pound is currently trading at a discount of 20% on the parallel market and we think the authorities will ultimately devalue the pound to 35/$ by year-end. There’s a risk that it overshoots,” Capital Economics added.

The Egyptian pound has been devalued by 50 percent, due to global economic turmoil, triggered by the Russian-Ukrainian war, as well as the high global inflation rates.