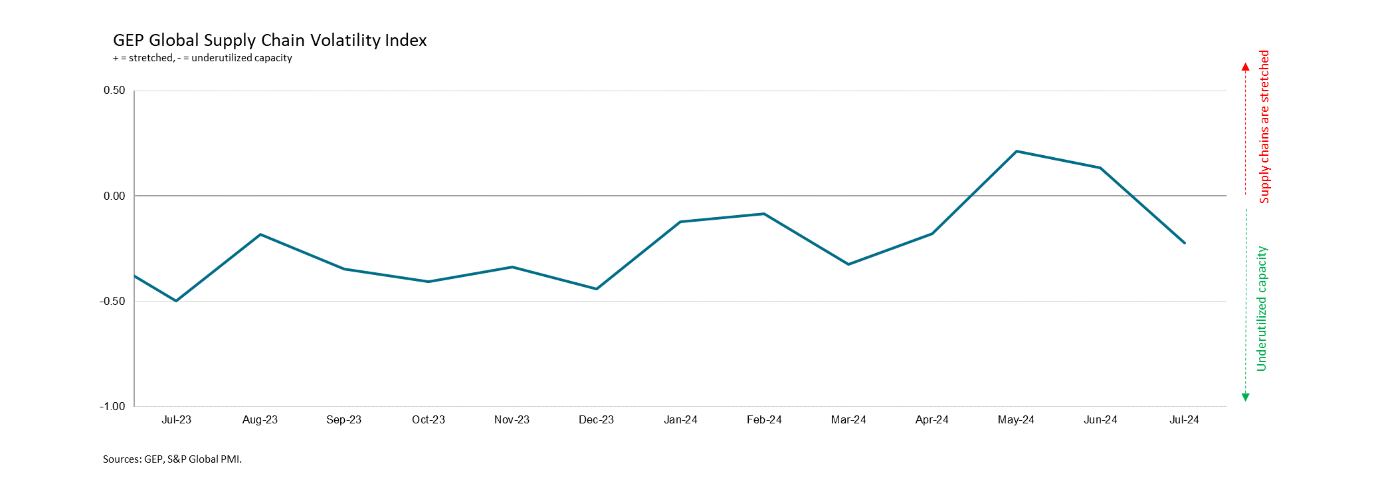

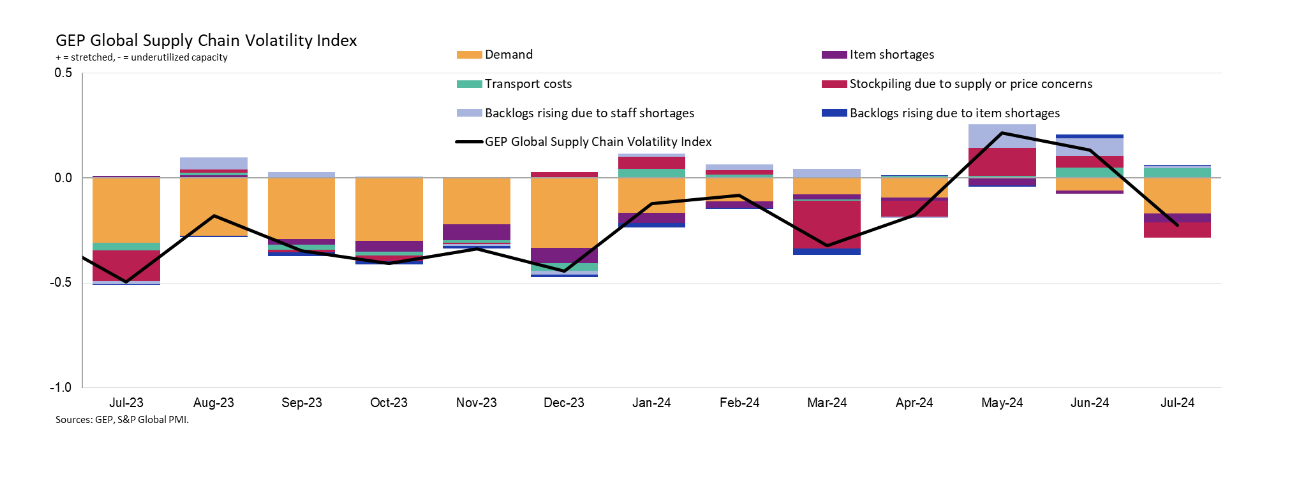

A sharp decline in demand for raw materials and semi-finished goods has signaled a slowdown in global economic growth. The GEP Global Supply Chain Volatility Index, which tracks supply chain conditions, revealed underutilized capacity among global suppliers for the first time since April.

Europe, particularly Germany, continues to grapple with a manufacturing recession, while Asia’s factory activity has contracted to its lowest point since December 2023. Even North America, a relative bright spot, has seen a softening of demand.

These findings suggest a potential for economic slowdown in the second half of the year, prompting calls for interest rate cuts. However, the overall supply chain remains efficient with no signs of stockpiling or shortages.

“In July, purchasing activity by global manufacturers declined, indicating that economic growth is slowing, adding to the calls for the Federal Reserve to lower interest rates sooner rather than later,” commented Mike Jette, vice president, consulting, GEP. “This is not alarming data. The world’s supply chains continue to operate efficiently, with no sign of stockpiling, shortages, or price pressures. But to head off any material slowdown in the second half of the year, manufacturers do need demand to increase.”

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP and is derived from S&P Global’s PMI® surveys, sent to companies in over 40 countries, totaling around 27,000 companies. The headline figure is a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators compiled by S&P Global.

Attribution: PMI