The International Monetary Fund (IMF) has completed its Post Financing Assessment for South Africa, confirming the country’s ability to meet its repayment obligations. The report highlighted persistent challenges such as sluggish growth, high unemployment, and rising public debt faced by the new government, which took office in June.

Looking ahead, the IMF projects South Africa’s growth to improve slightly to 1 per cent in 2024, with medium-term growth stabilising at 1.4 per cent as structural reforms gradually take effect. However, inflation is expected to decline to target levels by mid-2025, while public debt is unlikely to stabilise soon due to ongoing fiscal pressures. Risks to the outlook include a fragile external environment and potential delays in key reform measures.

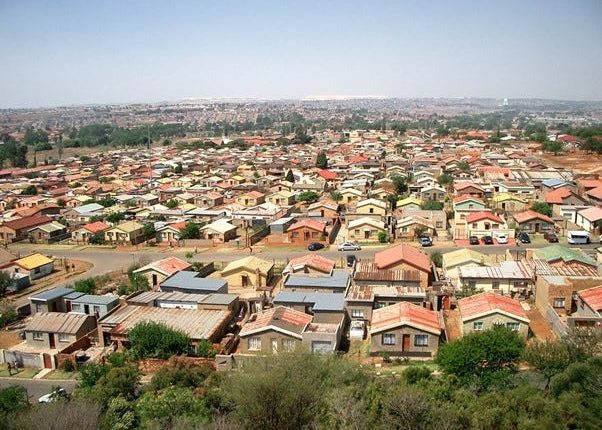

In 2023, economic growth had slowed to 0.7 per cent due to widespread power shortages and transport disruptions, with unemployment reaching 32 per cent. Inflation dropped to 5.1 per cent by June 2024, and the budget deficit remained on target, though public debt rose to more than 74 per cent of GDP.

The IMF called on the government to accelerate reforms in electricity, transport, and labour markets, which are crucial for boosting economic recovery and job creation. It also recommended fiscal consolidation of 3 per cent of GDP to manage rising debt, while advising the central bank to maintain a cautious stance until inflation is firmly within the target range. Reforms in the banking sector to enhance financial stability were also highlighted as key priorities.

South Africa’s repayment capacity remains adequate under both baseline and downside scenarios, supported by a flexible exchange rate that can act as a buffer against external shocks.

Attribution: IMF

Subediting: M. S. Salama